利息理论习题

1.1

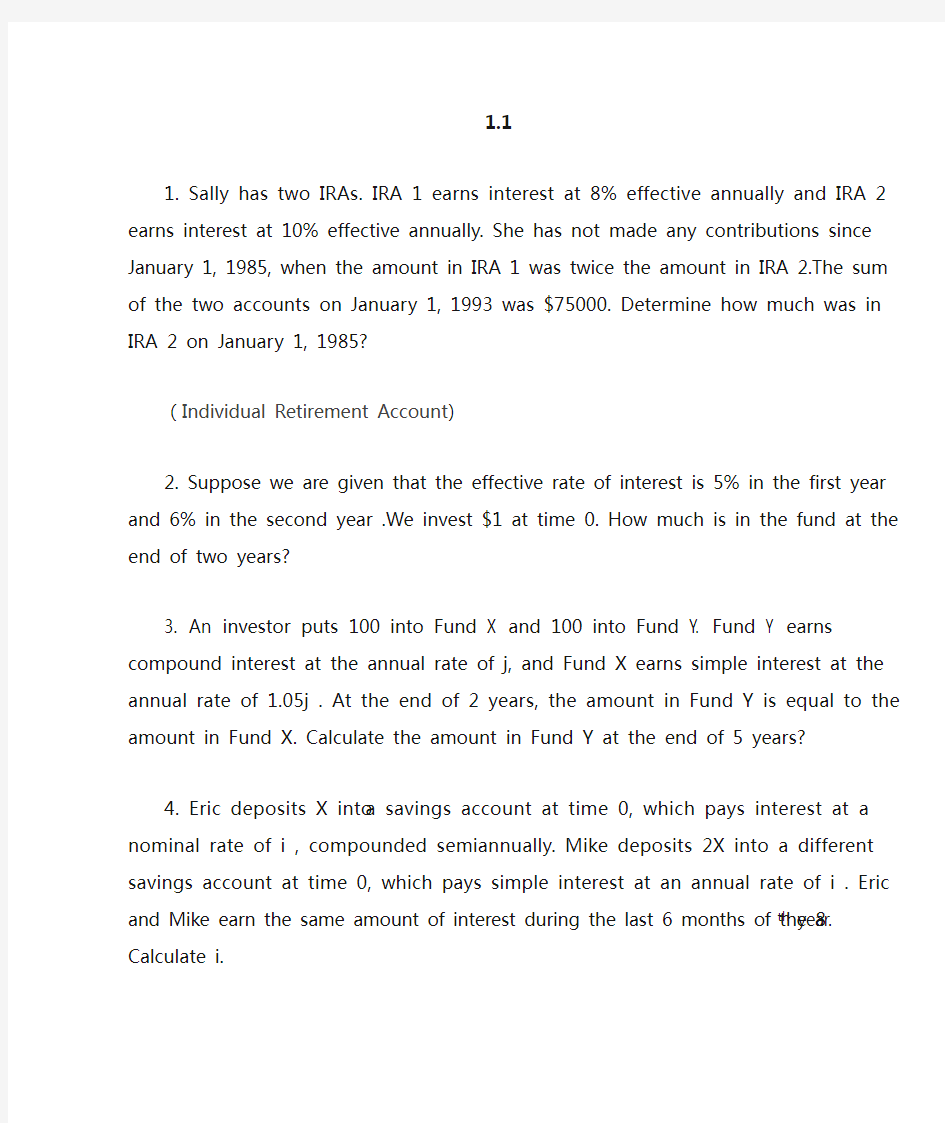

1. Sally has two IRAs. IRA 1 earns interest at 8% effective annually and IRA 2 earns interest at 10% effective annually. She has not made any contributions since January 1, 1985, when the amount in IRA 1 was twice the amount in IRA

2.The sum of the two accounts on January 1, 1993 was $75000. Determine how much was in IRA 2 on January 1, 1985? (Individual Retirement Account)

2. Suppose we are given that the effective rate of interest is 5% in the first year and 6% in the second year .We invest $1 at time 0. How much is in the fund at the end of two years?

3. An investor puts 100 into Fund X and 100 into Fund Y. Fund Y earns compound interest at the annual rate of j, and Fund X earns simple interest at the annual rate of 1.05j . At the end of 2 years, the amount in Fund Y is equal to the amount in Fund X. Calculate the amount in Fund Y at the end of 5 years?

4. Eric deposits X into a savings account at time 0, which pays interest at

a nominal rate of i , compounded semiannually. Mike deposits 2X into a different savings account at time 0, which pays simple interest at an annual rate of i .Eric and Mike earn the same amount of interest during

the last 6 months of the 8th year. Calculate i.

5. John invests 1000 in a fund which earns interest during the first year at a nominal rate of K convertible quarterly. During the 2nd year the fund earns interest at a nominal discount rate of K convertible quarterly. At the end of the 2nd year, the fund has accumulated to 1173.54. Calculate K.

6. A deposit of X is made into a fund which pays an annual effective interest rate of 6% for 10 years. At the same time, X/2 is deposited into another fund which pays an annual effective rate of discount of d for 10 years. The amounts of interest earned over the 10 years are equal for both funds. Calculate d.

7. You are given: 2()A t Kt Lt M =++for 02t ≤≤

(0)100,(1)110,(2)136A A A === Determine the force of interest at time 12

t =

. 8. At time 0, 100 is deposited into Fund X and also into Fund Y. Fund X accumulates at a force of interest ()20.51t t δ-=+. Fund Y accumulates at an annual effective interest rate of i . At the end of 9 years, the accumulated value of Fund X equals the accumulated value of Fund Y. Determine i .

1.2

1. At an effective annual interest rate of ,0

i i>, each of the following two sets of payments has present value K:

1) A payment of 121 immediately and another payment of 121 at

the end of one year.

2) A payment of 144 at the end of two years and another payment

of 144 at the end of three years. Calculate K.

2. You are given:

1)The sum of the present values of a payment of X at the end of 10

years and a payment of Y at the end of 20 years is equal to the

present value of a payment of X+Y at the end of 15 years.

2)X+Y=100

3)5%

i=. Calculate X.

3.A customer is offered an investment where interest is calculated

according to the following force of interest :

0.0203

0.0453 t

t t

t

δ

≤≤

?

=?

>

?

The customer invests 1000 at time 0. What nominal rate of interest , compounded quarterly, is earned over the first four-year period?

4. Payments of 300,500 and 700 are made at the end of years five, six

and eight, respectively. Interest is accumulated at an annual effective rate of 4%. You are to find the point in time at which a single payment of 1500 is equivalent to the above series of payments. You are given:

1) X is the point in time calculated by the method of equated time

2) Y is the exact point in time. Calculate X+Y.

5.Jones agrees to pay an amount of 2X at the end of 3 years and an amount of X at the end of 6 years. In return he will receive 2000 at the end of 4 years and 3000 at the end of 8 years. At an 8% effective annual interest rate , what is the size of Jone s’ second payment?

6. David can receive one of the following two payment streams:

1) 100 at time 0, 200 at time n, and 300 at time 2n

2) 600 at time 10

At an annual effective interest rate of i ,the present value of the two

streams are equal. Given 0.75941n v , determine i

7. You are given two loans, with each loan to be paid by a single payment in the future. Each payment includes both principal and interest.

The first loan is repaid by a 3000 payment at the end of four years. The interest is accrued at 10% per annum compounded semiannually. The second loan is repaid by a 4000 payment at the end of five years. The interest is accrued at 8% per annum compounded semiannually.

These two loans are to be consolidated. The consolidated loan is to be repaid by two equal installments of X, with interest at 12% per annum compounded semiannually. The first payment is due immediately and the second payment is due one year from now. Calculate X

8. At a certain interest rate the present value of the following two patterns are equal:

1)200 at the end of 5 years plus 500 at the end of 10 years

2)400.94 at the end of 5 years

At the same interest rate, 100 invested now plus 120 invested at the end of 5 years will accumulate to P at the end of 10 years. Calculate P

2.1

例2.1.2 一项贷款,总额为1000元,年利率为9%.设有一下三种偿还方式:

(1)贷款总额以及应付利息在第10年年末一次性偿还;

(2)每年年末偿还该年度的应付利息,本金在第10年年末偿还;(3)在10年中美年年末进行均衡偿付。

分别计算在三种偿还方式下所支付的利息额。

例2.1.5 某人购房借款50000元,计划每年年末还款10000元,直到还完为止。设利率为7%,分三种方式求该借款人还款的整数次数以及最后的还款零头。其中零头的还款时间分别为:

(1)在时刻n与n+1之间。

(2)在时刻n。

(3)在时刻n+1。

1. Susan and Jeff each make deposits of 100 at the end of each year for 40 years. Starting at the end of the 41st year, Susan makes annual withdrawals of X for 15 years and Jeff makes annual withdrawals of Y for 15 years. Both funds have a balance of 0 after the last withdrawal. Susan’s fund earns an annual effective interest rate of 8%. Jeff’s fund

earns an annual effective interest rate of 10%. Calculate Y X

2. At an annual effective interest rate of 6.3%, an annuity immediate with 4N level annual payments of 1000 has a present value of 1411

3. Determine the fraction of the total present value represented by the first set of N payments and the third set of N payments combined.

3. An investment requires an initial payment of 10000 and annual payment of 1000 at the end of each of the first 10 years. Starting at the end of the 11th year, the investment returns 5 equal annual payments of X. Determine X to yield an annual effective rate of 10% over the 15-year period.

4. The present value of a series of payments of 2 at the end of every 8

years, forever, is equal to 5. Calculate the effective rate of interest.

5. Chuck needs to purchase an item in 10 years. The item costs 200 today, but its price inflates at 4% per year. To finance the purchase, Chuck deposits 20 into an account at the beginning of each year for first 6 years. He deposits an additional X at the beginning of years 4,5,6 to meet his goal. The annual effective interest rate is 10%. Calculate X

6. Deposits of 1000 are placed into a fund at the beginning of each year for 30 years. At the end of the 40th year, annual payments commence and continue forever. Interest is at an effective annual rate of 5%. Calculate the annual payment.

7. The following three series of payments have the same present value of P: 1) a perpetuity-immediate of 2 per year at an annual effective interest rate of i

2) a 20-year annuity-immediate of X per year at an annual effective interest rate of 2i

3) a 20-year annuity-due of 0.96154X per year at an annual effective interest rate of 2i. Calculate P

8. At a nominal rate of interest i, convertible semiannually, the present

value of a series of payments of 1 at the end of every 2 years, forever, is 5.89. Calculate i

2.2

例1

在20年期间,每月支付1500元,年利率为7%。求

(1)这些付款在前3年的现值;

(2)这些付款在最后一次付款后的第5年末的积累值。

例2

(1)已知某种年支付额为10000元,分期于每月月末支付一次相等金额,支付期10年,年实际利率是5%,该年金的现值是多少?

(2)如果年名义利率是5%,每季结算一次利息,其余条件相同,此时年金的现值又是多少?

1. Jerry will make deposits of 450 at the end of each quarter for 10 years. At the end of 15 years, Jerry will use the fund to make annual payments

of Y at the beginning of each year for 4 years, after which the fund is exhausted. The annual effective rate of interest is 7%. Determine Y

2. The present value of a 5-year annuity immediate, with payments of 1000 each 6 times per year, is 20930. Determine the force of interest.

3. Harriet wishes to accumulate 60000 in a fund at the end of 25 years.

She plans to deposit 80 into the fund at the end of each of the first 120 months. She then plans to deposit 80+x into the fund at the end of each of the last 180 months. Assume the fund earns interest at an annual effective rate of 3.66%. Determine x

4. Jim and Sue are planning to retire on January 1,199

5. Their goal is to have enough money in savings to be able to withdraw 3000 per month beginning one month after retirement and continuing for 25 years after retirement. They earn an annual effective rate of interest of 10% on their account. Determine the minimum amount needed in their savings account on January 1,1995, to accomplish their goal.

5. John wins 1000000 in a lottery and will be paid 20 equal annual installments of 50000 with the first payment due today. A bank offers to exchange John’s winnings for a perpetuity of X per month with the first payment due today. Find the value of X assuming a 10% effective rate of interest.

6. The proceeds of a 10000 death benefit are left on deposit with an insurance company for seven years at an annual effective interest rate of 5%. The balance at the end of seven years is paid to the beneficiary in 120 equal monthly payments of X, with the first payment made

immediately. During the payout period, interest is credited at an annual effective interest rate of 3%. Calculate X

7. A car dealer offers to sell a car for 10000. The current market loan rate is a nominal rate of interest of 12% per annum, compounded monthly. As an inducement, the dealer offers 100% financing at an effective

annual interest rate of 5%. The loan is to be repaid in equal installments at the end of each month over a 4-year period. Calculate the cost to the dealer of this inducement.

8. A payment of 100 is made at the end of each two months for a period of 6 years. The nominal annual rate of interest is 3%, convertible every 8 months. Find the present value of this series of payments.

2.3

1. Find the PV of a 14-year annuity with continuous payments at the rate of 650 a year at an effective interest rate of 5.65%

2. You are given:

1) 107.52a =2)()1033.865d a d δ

=-Calculate δ 3. Given the information 3113.987,23.6914n n a

s ++== , find 1s

4. You are given

0100n t a dt =?, Calculate n

a

2.4 1. Kathy deposits 100 into an account at the beginning of each 4-year period for 40 years. The account credits interest at an annual effective interest rate of i . The accumulated amount in the account at the end of 40 years is X, which is 5 times the accumulated amount in the account at the end of 20 years. Calculate X

2. The present value of a perpetuity of 6500 paid at the end of each year plus the present value of a perpetuity of 8500 paid at the end of every 5 year is equal to the present value of an annuity of k paid at the end of each year for 25 years. Interest is 6% convertible quarterly. Calculate k

3. A 20-year annuity pays 100 every other year beginning at the end of the second year, with additional payments of 300 each at the end of years 3,9,15. The effective annual interest rate is 4%. Calculate the present value of the annuity.

4. You are given:

1) The present value of a 6n-year annuity-immediate of 1 at the end of every year is 9.996

2)The present value of a 6n-year annuity-immediate of 1 at the end of

every second year is 4.76

3)The present value of a 6n-year annuity-immediate of 1 at the end of

every third year is X

Calculate X

5. Determine the present value of 1 payable at the end of years

7,11,15,19,23 and 27

6. You have an annuity which pays 1200 every two years. The first payment is two years from now and the last payment is ten years from now. You can trade that annuity for another annuity of equivalent present value, which pays 180 per quarter starting today. The interest rate for both annuities is 4% per annum convertible quarterly. If you took the second annuity, how many quarterly payments would you receive? The last payment may be less than 180 but not more than 180

7. A perpetuity of 1 each year, with the first payment due immediately, has a present value of 25 at an annual effective rate of i. The owner exchanges it for another perpetuity with the first payment due immediately and subsequent payments due at two years intervals. What

should the payment of the second perpetuity be, in order to keep the same interest rate i and the same present value?

2.5

1. Find the AV of a 12-year annuity-immediate with annual payments of 1225, 2575, 3925, 5275, ……

2. An annuity provides for 12 annual payments. The first payment is 100, paid at the end of the first year, and each subsequent payment is 5% more than the one preceding it. Calculate the present value of this i

annuity if 0.07

3. Joe can purchase one of two annuities:

1) A 10-year decreasing annuity-immediate, with annual payments of

10, 9, 8, …, 1

2) A perpetuity-immediate with annual payments. The perpetuity pays

1 in year 1,

2 in year 2,

3 in year 3,… , and 11 in year 11. After 11, the

payments remain constant at 11

At an annual effective interest rate of i, the present value of 2) is twice the present value of 1). Calculate the present value of 1)

4. Jake inherits a perpetuity that will pay him 10000 at the end of the

first year increasing by 10000 per year until a payment of 150000 is made at the end of the 15th year. Payments remain level after the 15th year at 150000 per year. Determine the present value of this perpetuity, assuming a 7.5% annual interest rate

5. Brian buys a 10-year decreasing annuity-immediate with annual payments of 10, 9, 8, …, 1. On the same date, Jenny buys a

perpetuity-immediate with annual payments. For the first 11 years, payments are 1, 2, 3,…, 11. After year 11, payments remain constant at 11.At an annual effective interest rate of i, both annuities have a present value of X. Calculate X

6. The first payment of a perpetuity-immediate is 60. Subsequent payments decrease by 1 per year until they reach a level of k. Payments remain constant at k thereafter. The present value of the perpetuity is equal to the present value of a perpetuity-immediate paying 44 each year. The annual effective interest rate is 5%. Calculate k

7. An annuity provides for 10 annual payments. The first of these payments is 100 and each subsequent payment is 10 higher than the one preceding it. Find the present value of this annuity at the time one year

i

prior to the first payment if 10%

8. You are given an annuity-immediate paying 10 for 10 years, then decreasing by one per year for 9 years and paying one per year thereafter, forever. The annual effective rate of interest is 4%. Calculate the present value of this annuity

3.123

1. On January 1,1997, an investment account is worth 100000. On April 1,1997, the value has increased to 103000 and 8000 is withdrawn. On January 1,1999, the account is worth 10399

2. Assuming a dollar weighted method for 1997 and a time weighted method for 1998, the annual effective interest rate was equal to x for both 1997 and 1998. Calculate x

3. On January 1,1997, Brian’s stock portfolio is worth 100000. On September 30,1997,5000 is withdrawn from the portfolio, and immediately after this withdrawal the portfolio has a value of 105000. 12 months later, the value of the portfolio is 108000,and Brian adds 3000 worth of stock to his portfolio. On December 31,1998, the portfolio is worth 100000. What is the time-weighted rate of return for Brian’s stock portfolio over the two-year period?

4. On January 1,1999, Lucy deposits 90 into an investment account. On

April 1,1999, when the amount in Lucy’s account is equal to X, a withdrawal of W is made. No further deposits or withdrawals are made to Lucy’s account for the remainder of the year. On December 31, 1999, the amount in Lucy’s account is 85. The dollar-weighted return over the 1-year period is 20%. The time-weighted return over the 1-year period is 16%. Calculate X

5. On January 1, an investment account is worth 100. On May 1,the value has increased to 120 and D is deposited. On November 1, the value is 100 and 40 is withdrawn. On January 1 of the following year, the investment account is worth 65. The time-weighted rate of interest is 0%. Calculate the dollar-weighted rate of interest.

6. On January 1, an investment account is worth 300000. M months later, the value has increased to 315000 and 15000 is withdrawn. 2M months prior to the end of the year, the account is again worth 315000 and 15000 is withdrawn. On December 31, the account is worth 315000. The annual effective yield rate, using the dollar-weighted method, is 16%.Calculate M

7. A fund earned investment income of 9200 during 1991. The beginning and ending balances of the fund were 100000 and 129200, respectively.

A deposit was made at time K during the year. No other deposits or withdrawals were made. The fund earned 8% in 1991 using the dollar-weighted method. Determine K

8. An investment fund has a value of 1000 at the beginning and the end of the year. A deposit of 200 was made at the end of 4 months. A withdrawal of 300 was made at the end of 7 months. Find the rate of interest earned by the fund assuming simple interest during the year.

3.5

1. 1000 is deposited into Fund X, which earns an annual effective rate of 6%. At the end of each year, the interest earned plus an additional 100 is withdrawn from the fund. At the end of the tenth year, the fund is depleted. The annual withdrawals of interest and principal are deposited into Fund Y, which earns an annual effective rate of 9%. Determine the accumulated value of Fund Y at the end of year 10.

2. Victor invested 300 into a bank account at the beginning of each year for 20 years. The account pays out interest at the end of every year at an annual effective interest rate of i .The interest is reinvested at an annual effective rate of 2

i .The yield rate on the entire investment over the 20 year period is 8% annual effective. Determine i

3. Eric deposits 12 into a fund at time 0 and an additional 12 into the same fund at time 10. The fund credits interest at an annual effective rate of i. Interest is payable annually and reinvested at an annual effective rate of 0.75i. At time 20, the accumulated amount of the reinvested interest payments is 6

4. Calculate i

4. Payments of 1000 are invested at the end of each year for 5 years. The payments earn interest at an annual effective rate of 10%. The interest can be reinvested at an annual effective rate of 6% in the first 4 years and at an annual effective rate of k thereafter. The amount in the fund at the end of 5 years is 6090. Calculate k

5. Bill deposits 1000 into a fund for 15 years. The fund pays interest at the end of each 6-month period at a nominal annual rate of i convertible semiannually. The interest payments are reinvested in a separate fund earning interest at an annual effective rate of 6%. During the 15-year period, Bill earns an annual effective yield of 7.56%. Calculate i

6. An investor pays P for an annuity which provides payments of 100 at the beginning of each month for 10 years. These payments are invested at a nominal annual interest rate of 12% convertible monthly. Monthly interest payments are reinvested at a nominal annual interest rate of 6%

convertible monthly. The annual yield rate over the 10-year period is 8% effective. Calculate P

7. Esther invests 100 at the end of each year for 12 years at an annual effective interest rate of i.The interest payments are reinvested at an annual effective rate of 5%. The accumulated value at the end of 12 years is 1748.4. Calculate i

8. A deposit of 1 is made at the end of each year for 30 years into a bank account that pays interest at the end of each year at j per annum. Each interest payment is reinvested to earn an annual effective interest j. The accumulated value of these interest payments at the rate of 2

end of 30 years is 72.88. Determine j

4.1

1. Seth borrows X for 4 years at an annual effective interest rate of 8%,to be repaid with equal payments at the end of each year. The outstanding loan balance at the end of the second year is 1076.82 and at the end of the third year is 559.1

2. Calculate the principal repaid in the first payment.

2. Mike borrows X for 10 years at an annual effective rate of 6%. If he pays the principal and accumulated interest in one lump sum at the end

of 10 years, he would pay 356.54 more in interest than if he repaid the loan with 10 level payments at the end of each year. Calculate X

3. A 6000 loan is being repaid with regular payments of X at the end of each year for as long as necessary plus a smaller payment one year after the final regular payment. Immediately after the ninth payment, the outstanding principal is 3 times the size of the regular payment. If the annual interest rate i is 10%, what is the value of X?

4. A loan, at a nominal annual interest rate of 24% convertible monthly, is to be repaid with equal payments at the end of each month for 2n months. The nth payment consists of equal payments of interest and principal. Calculate n

5. A loan is being repaid in 5 annual payments. The first two payments are 200. The third and fourth payments are 400. The final payment is 500. The annual effective interest rate is 6%.Determine the interest portion of the third payment

6. Carla borrowed 100000 on January 1,1996. She will make 10 annual payments of 10000 to the lender beginning on January 1,199

7. In addition, she will make monthly payments of amount X to the lender beginning February 1,1996, and continuing for 15 years. You may assume

利息理论复习题4

第四章 1.某总额1000元的债务,原定将分10年于每年年末等额偿付,合同年有效利率为5%。当第4次偿付完成时,年利率上调为6%,如果余下6次等额还款,则每次还款额为(133.67)元。 3.甲向乙借款10000元,约定在未来的6年内按照季度等额还款,利率为季度转换8%。在第2年的年末,乙将未来的收款权转让给了丙,转让价产生季度转换年收益率10%,则丙收到的总利息为(1557)元 5.某用于偿债的基金,预计每年获得3.5%的收益,每年末由基金支出10000元用于偿债,连续支付10年,刚好能够完成所有债务。该基金运作后每年的实际收益率为5%,在前5年仍按照原计划支付。试计算第5年的年末基金余额超过预计余额的数额为(5736)元。 6.已知某住房贷款100000元,分10年还清,每月末还款一次,每年计息12次的年名义利率为6%,则在还款50次后的贷款余额为(65434.8)元。 8.某借款人每年末还款1000元,共20次。在第5次还款时,他决定将手头多余的2000元也作为偿还款,然后将剩余贷款期调整为12年,若利率为9%,计算调整后每年的还款额为(846.4)元 10.一笔贷款的归还计划是15年,每年1000元,年复利为5%。在第5次还款后贷款的计划发生变化,新的还款计划是第6次还款800元,第7次还款800+k元,以后每次还款额都在上次基础上增加k元,还款期限不变,则最后一次还款金额为(1240)元。 32.某贷款人的还款期限为51,每年计息两次的年名义利率为i.。计 算第8。 34.某人向银行贷了10年的款,年利率为6%,每年末还款一次,首期还款300元,以后每期比前期还款增加10元。计算第6次还款中的利息与本金部分分别为(93.2,256.8)元。 110.甲需要1000元助学贷款,分4年偿还,有A.B两家银行可提供这笔贷款。 (1)A银行要求甲用偿债基金法还款,贷款利率10%,偿债基金存款利率8%; (2)B银行要求甲用分期偿还计划还款。 计算B银行与A银行等价的贷款利率(10.94%)。 131.王先生借款10万元,为期15年,年利率4%,若采用偿债基金还款方式,偿债基金存款利率为3%,计算第3次还款中净利息部分为(3672.56)元。

利息理论第一章课后答案

1. 已知A (t ) +5,求 (1)对应的a (t );A (0)=5 a (t )=()(0)A t A =25t +5+1 (2)I 3;I (3)i 4; i 4=4(4)(3)(3) (3)I A A A A -=== 2.证明:(1)()()(m 1)(2).....A n A m I I m In -=+++++ (2)()(1)(1).A n in A n =+- (1) ; ()()()(1)(1)(2)....(1)()1...Im 1A n A m A n A n A n A n A m A m In In -=--+---++-=+-+++ (m 利息理论第四章课后答案 1.某人借款1万元,年利率12% ,采用分期还款方式,每年末还款2000元,剩余不足2000元的部分在最后一次2000元还款的下一年偿还。计算第5次偿还款后的贷款余额。 解:.B5 =10000 1.125 - 2000乌0.12=4917.7 2.甲借款X,为期10年,年利率8%,若他在第 10年末一次性偿还贷款本利和,其中的利息部分要比分10年期均衡偿还的利息部分多468.05元,计算X。 解:x(1.08T —1)—(卫、—x)=468.05,x =700.14 a i010.08 3.—笔贷款每季末偿还一次,每次偿还1500元, 每年计息4次的年名义利率为10%。若第1 年末的贷款余额为12000元,计算最初贷款额 r 10 0 4 解: B4=L(1 0) -1500S 10 ^ =1200, L =16514.37 4~4~ 或L=12000v41500a 10%=16514.37 4—4_ 4.某人贷款1万元,为期10年,年利率为i,按偿债基金方式偿还贷款,每年末支出款为X,其中包括利息支出和偿债基金存款支出,偿债基金存款利率为2i,则该借款人每年需支出额为1.5X,计算i。 10000=(1.5x-20000i)S 二i =6.9% 5.某贷款期限为15年,每年末偿还一次,前 5 年还款每次还4000元,中间5次还款每次还3000元,后5次还款每次还2000元,分别按过去法和未来法,给出第二次3000元还款之后的贷款余额表达式。 解: 过去法:B;=1000(2a词a^+唧(1 i)7 -1000[4S5(1 i)2 3乌] =1000(2a^+a诃+a^) (1+i) 7-1000(4S^-S2) 未来法:B7 =3000a32000a5V^1000(2a8a3) 6.一笔贷款按均衡偿还方式分期偿还,若B t,B t”, B t+2,B t+3为4个连续期间末的贷款余额,证明: (1) 2 (B t-B t+1)( B t+2-B t+3)= ( B t+1-B t+2) (2)B t +B t+3 % B t+1 +B t+2 解: B t^pa n」B t 1=P a n_Ld B t2=P a n_t^ B心二卩弘」」 (1) (3 -B t 1)(B t 2 P 3)=卩丁卷-a L)(a;r^ -孔日 2 n 4 .1 n 4 .3 或二p v 刑0] 或=p2(V n4^a^)2 或=(B1-B t2)2 (2) B t _Bt 彳::B t 2 - B t 3 = v n_t4 :: V n」;=V2:1 7.某人购买住房,贷款10万元,分10年偿还, 中国矿业大学 (2009~2010第二学期) 《利息理论》试卷(A ) (2010年6月) (理学院应用数学 2007级使用) 考试时间: 120分钟 考试方式: 闭卷 一、简答以下各题(每小题6分,共60分) 1、 201 2lim d d δδ →-=证明: n n n n 2n 1 2......n, Ia) -nV Ia)i a 、有一期年末付年金,第一次付款额为,第二次付款额为,,最后一次付款额为该年金现值记为(证明:(= (查笔记) 3、在住房公积金贷款中,还款频率(一般每月还款一次)大于计息频率(一般每年计息一次),现在考虑各期还款问题。 设m 是每个计息期内的还款次数,n 是计息期数,i 为每个计息期的利率,m ,n 为正整数,总的还款次数为mn 。假定每个付款期期末付款额度为m 1,还款年金现值记为()m n a 。 证明:| )(n a m =)(1m n i v -(查笔记) 4、假设实利率为8%,计算以下现金流的久期: (1)10年期无息票债券对应的现金流 (2)年息率为8%的10年期债券对应的现金流(写出算式)。 5、已知永久年金的付款方式为:第5、6年底各100元,第7、8年底各200元,第9、10年底各300元,依次类推。证明其现值为: 4100v i vd 元 6、某投资者连续5年每年初向基金存款1000元,年利率5%,同时利息收入以年利率4%再投资。给出第10年底的累积余额表达式。 7、企业进行项目投资,都要进行经济分析,反映收益大小的指标是净现值NPV 和内部收益率IRR ,通过现金流量分析,得出现金流为 012,,,n c c c c , (1) 给出NPV 、IRR 的计算公式或方法 (2) 现有两个项目(生命周期相同)二选一,给出选择规则 8、某贷款分10次偿还,其中第一次还款10元,第二次还款9元,依次类推。证明:第六次还款中的利息为 55)a (元 1.已知A (t )=2t+t +5,求 (1)对应的a (t );A (0)=5 a (t )=()(0)A t A =25t +5t +1 (2)I 3;I 3=A(3)-A(2)=2*3+3+5-(2*2+2+5)=2+32- (3)i 4; i 4=4(4)(3)2*445(2*335)43 (3) (3)113113I A A A A -++-++-=== ++ 2.证明:(1)()()(m 1)(2).....A n A m I I m In -=+++++ (2)()(1)(1).A n in A n =+- (1) ()()()(1)(1)(2)....(1)()1...Im 1A n A m A n A n A n A n A m A m In In -=--+---++-=+-+++ (m 货币的时间价值与利息理论基础知识课后测试 货币的时间价值与利息理论基础知识课后测试 ?货币的时间价值与利息理论基础知识 课后测试 如果您对课程内容还没有完全掌握,可以点击这里再次观看。 测试成绩:100.0分。恭喜您顺利通过考试! 单选题 1. 将1万元人民币存入银行,两年后得到1万零300元,此时货币的时间价值是:√ A 0.1 B 0.03 C 0.3 D 0.2 正确答案: B 2. 下列关于货币时间价值的说法,正确的是:√ A 研究货币的时间价值要考虑风险和通货膨胀 B 研究的目的是对于现在的投入,将来可以回收多少资金 C 企业在研究投资项目时,可以不考虑社会平均利润率 D 是评价投资方案的标准之一 正确答案: D 3. 最典型的现金流量计算要包括:√ A 时间间隔长短 B 金额的高低 C 终值、现值和年金 D 投资回报率 正确答案: C 4. 张小姐在银行存入5万元,银行利率为5%,5年后取回,那么连本带利的终值是:√ A 577881 B 59775 C 55125 D 63814 正确答案: D 5. 下列关于单利和复利的表述,正确的是:√ A 对于较长时间的存款,复利可以比单利产生更大的终值 B 单利俗称“利滚利” C 在单个度量期内,单利和复利的终值不相同 D 复利在同样长时期增长的绝对金额为常数 正确答案: A 6. 已知年利率为15%,按季计息,则有效年利率比名义年利率高:√ A 0.1586 B 0.0086 C 0.0107 D 0.1007 正确答案: B 7. 某投资者希望两年后有一笔价值100000元的存款,假设年收益率为20%,则现在该投资者应该投 入:√ A 60000元 B 65000元 C 69444元 D 72000元 正确答案: C 1. 某人借款1000元,年复利率为9%,他准备利用该资金购买一张3年期,面值为1000元的国库券,每年末按息票率为8%支付利息,第三年末除支付80元利息外同时偿付1000元的债券面值,如果该债券发行价为900元,请问他做这项投资是否合适 2. 已知:1) 16 565111-++=+))(()()()(i i m i m 求?=m 2) 1 65 65111--- =- ))(()()()(d d m d m 求?=m 由于i n n i m m i n m +=+=+111)()() ()( 由于d n n d m m d n m -=-=- 111)()() ()( 3. 假设银行的年贷款利率12%,某人从银行借得期限为1年,金额为100元的贷款。银行对借款人的还款方式有两种方案:一、要求借款人在年末还本付息;二、要求借款人每季度末支付一次利息年末还本。试分析两种还款方式有何区别哪一种方案对借款人有利 4. 设1>m ,按从小到大的顺序排列δ,,,,)() (m m d d i i 解:由 d i d i ?=- ? d i > )()(m m d d >+1 ? )(m d d < )()(n m d i > ? )()(m m i d < )()(m m i i <+1 ? i i m <)( δδ+>=+11e i , δ==∞ →∞ →)()(lim lim m m m m d i ? i i d d m m <<<<)()(δ 5. 两项基金X,Y 以相同的金额开始,且有:(1)基金X 以利息强度5%计息;(2) 基金Y 以每半年计息一次的名义利率j 计算;(3)第8年末,基金X 中的金额是基金Y 中的金额的倍。求j. 中国海洋大学继续教育学院命题专用纸 试题名称 : 利息理论 学年学期: 2019学年第一学期 站点名称: 层次: 专业: 年级: 学号: 姓名: 分数: 考试时间:90分钟。总分:100分。 一、选择题(每小题2分,共5个小题,满分10分) 1.有一项永久年金,在第3年末付款1个单位元,在第6年末付款2个单位元,在第9年末付款3个单位元,求该年金的现值,已知年利率为6%i =。( D ) (A ) 34.6; (B ) 33.6; (C ) 31.6; (D ) 32.6; (E )30.6. 2.有一项期末付年金,其付款额从1开始每年增加1,直到n ,然后每年减少1直到1,试求该年金的现值( B ) (A )n n s s ?; (B )n n a a ?; (C )n n a s ?; (D )n n s a ?; (E )n n a s ?. 3.某优先股在第一年末支付20元分红 ,以后每年度末的分红比前次多8%,该优先股 的实际收益率为10%,求该优先股的售价。( A ) (A )1000; (B )1080; (C )1100; (D )1120; (E )1140 4. 一笔9.8万元的贷款,每月末还款777元,一直支付到连同最后一次较小的零头付 款还清贷款为止,每月计息一次的年名义利率为4.2%,试求第7次付款中的本金部分。( C ) (A )399.27; (B )400.27; (C) 443.19;(D )356.73; (E )366.73. 5.一项实际利率为6%的基金在年初有100元,如果在3个月后存入30元到该基金,而9个月后则从基金中抽回20元,假定1(1)t t i t i -=-,求一年后的基金余额。( C ) (A )87.05; (B )7.05; (C )117.05; (D )77.05; (E )97.05 二、(10分)8000元的贷款,年利率12%,3个月末还2000元,9个月末还4000元,12个月末还X 元。分别利用(1)联邦规则;(2)商业规则,求X 。 三、(10分) 机器甲售价1万元,年度维修费250元,寿命25年,残值为200元;机器乙的寿命20年,无 利息理论第四章课后答案 ————————————————————————————————作者:————————————————————————————————日期: 1. 某人借款1万元,年利率12%,采用分期还款方式,每年末还款2000元,剩余不足2000 元的部分在最后一次2000元还款的下一年偿还。计算第5次偿还款后的贷款余额。 解:550.125.10000 1.1220004917.7r B S =?-= 2. 甲借款X ,为期10年,年利率8%,若他在第10年末一次性偿还贷款本利和,其中的 利息部分要比分10年期均衡偿还的利息部分多468.05元,计算X 。 解:10100.08 10(1.081)( )468.05,700.14x x x x a ---== 3.一笔贷款每季末偿还一次,每次偿还1500元,每年计息4次的年名义利率为10%。若第 1年末的贷款余额为12000元,计算最初贷款额。 解: 000004 04 1044 4 104 4 10(1)15001200,16514.37 4150016514.37 r B L S L a =+-==+= 或L=12000v 4.某人贷款1万元,为期10年,年利率为i ,按偿债基金方式偿还贷款,每年末支出款为X , 其中包括利息支出和偿债基金存款支出,偿债基金存款利率为2i ,则该借款人每年需支出额为1.5X ,计算i 。 解:100.0810000(10000)x i S =- 00100.08 6.9i ?=10000=(1.5x-20000i)S 5.某贷款期限为15年,每年末偿还一次,前5年还款每次还4000元,中间5次还款每次还 3000元,后5次还款每次还2000元,分别按过去法和未来法,给出第二次3000元还款之后的贷款余额表达式。 解:7 2 715105521000(2+)(1)1000[4(1)3]r B a a a i S i S =++-++过去法: 71510572=1000(2a +a +a )(1+i)-1000(4S -S ) 373583300020001000(2)r a a V a a =+=+未来法:B 6.一笔贷款按均衡偿还方式分期偿还,若t t+1t+2t+3B B B B ,,,为4个连续期间末的贷款余 额,证明: (1)2 t t+1t+2t+3t+1t+2B -B B -B =B -B ()()() (2)t t+3 t+1t+2B +B B +B p 解:123123t t t t n t n t n t n t B pa +++-------= B =pa B =pa B =pa (1)2 123123()()()()t t t t n t n t n t n t B B B B p a a a a +++---------=-- 中山大学2009年上半年度 《利息理论》期末考试试题(B卷) 专业:学号:姓名: 【注意事项】 1、本试卷类型为B卷,请在答题纸上标明试卷类型。 2、本试卷共有35道题,均为单选题。请把答案写在答题纸上,写在其他任何地方都无效, 包括写在本试卷上也无效,后果自负。 3、答题完毕,请将本试卷和答题纸一同交给监考老师。 根据以下资料回答第1~2题。张三和李四分别在银行新开了一个账户,其中张三存入100元,李四存入40元,而且两人的年实际利率都相等。他们发现,在复利情况下,张三在第11年的应计利息和李四在第17年的应计利息相等,假设每年的利息都没有取出来。 【1】年实际利率等于() A.13.5% B.14.5% C.15.5% D.16.5% 【2】张三在第11年的应计利息等于() A.71元B.76元C.81元D.86元 【3】与名义年利率为15%的连续复利相当的半年复利的名义年利率是()。 A.13.577% B.14.577% C.15.577% D.16.577% 【4】小宋的年收入为10万元,已有储蓄5万元,打算5年后创业,需要创业资金30万元。假设年收益率为8%,收入固定不变。如果要实现这个目标,年储蓄率应等于()。 A.38.6% B.40% C.41.4 % D.42.8% 【5】现有一笔贷款,期限为以3.5年,要求每半年末支付等额数量来偿还债务,每年计息两次的名义利率为6%。在第4次付款后,未偿还贷款余额为5000元,那么初始贷款金额为:A.10813元B.10913元C.11013元D.11113元【6】假设你现在打算做一项为期10年的投资:每一年初投资1000元,此项投资的实质利率为8%,而其利息可按6%实质利率进行再投资,那么第十年末的基金金额可达到()。 A.15296元B.15396元C.15496元D.15596元【7】黄大伟现有5 万元资产与每年年底1 万元储蓄,以5%投资收益率计算,假设下列各目标之间互不相关,那么下列目标中无法实现的是()。 A.20 年后将有45万元的退休金B.3年后可以达成8.5万元的购车计划 《利息理论》考试试题(B 卷)参考答案 一、填空题(每题3分,共30分) 1、最先提出利息概念的是英国政治经济学家_威廉·配第__。 2、偿还贷款的两种基本方法分别为 分期偿还法和偿债基金法 。 3、假定一个单位的投资在每个单位时间所赚取的利息是相等的,而利息并不用于再投资。按这种形式增长的利息,我们称为 单利 。 4、将每次支付金额积累或贴现到比较期的方程称为 价值方程 。 5、利息强度一般用来衡量_某一时刻的资金总量___的变化率。 6、 利率风险结构 是指相同期限的金融工具在不同利率水平之间的关系,反映了这种金融工具所承担的风险的大小对其收益率的影响。 7、国际货币基金组织的贷款一般分为六种,它们是普通贷款、中期贷款、补偿与应急贷款(其前身为出口波动补偿贷款)、缓冲库存贷款、补充贷款和扩大资金贷款_。 8、年金相邻的两个计息日期之间的间隔称为 计息周期 。 9、连续年金现值表达式为 10、100元在单利3%的情况下3年后的积累值为_109_,如果在复利3%的条件下3年 后的积累值为 _109.27_。 二、选择题(每题3分,共30分) 1、一种五年到期、息票利率为8%、目前到期收益率为10%的债券。如果利率不变,一年后债券价格将(B )。 A .下降 B .上升 C .不变 D .不能确定 2、如果政府准备发行一种三年期的债券,面值为1000元,票面利率等于15%,每年末支付一次利息,那么这种债券的合理价格为(B )。 A .930元 B .940元 C .950元 D .960元 3、下列各种说法,错误的是(C )。 A .债券的期限越长,利率风险越高 B .债券的价格与利率呈反向关系 C .债券的息票率越高,利率风险越高 D .利率上涨引起债券价格下降的幅度比利率下降引起债券价格上升的幅度小 4、王女士于每年年初存入银行1000元钱,其中6%的年利率针对前4次的存款,10%的年利 n 第1页共2页 第2页共2页 安徽工程大学2010——2011学年第1学期 (利息理论)课程考试试卷(A )卷 考试时间120分钟,满分100分 要求:闭卷[√ ],开卷[ ];答题纸上答题[√ ],卷面上答题[ ] (填入√) 一、名词解释(每题5分,共20分) 1.利率的平均到期期限 2.融资费用 3.利息力函数 4. 广义年金 二、证明 (每题10分,共10分) 证明:(1)t n t t n n s a i a a -+- = 。 三、计算题 (每题10分,共70分) 1. 某人在2年后投资2000元,在4年后再投资3000元,设整个投资计划的现值是4000元,这个投资计划的实际年利率是多少? 2.一项贷款,总额为1000元,年利率是9%,设有以下三种偿还方式: (1)贷款总额以及应付利息在第10年年末一次性偿还;(2)每年年末偿还该年度的的应付利息,本金在第10年年末偿还;(3)在10年中每年年末进行的均衡偿还。分别计算在三种偿还方式下所支付的利息额。 3.某人在第一年年初向基金投资1000元,在第一年年末抽走年初投资的1000元 本金,并从该基金中借出1150元,在第二年年末向该基金偿还了1155元清帐。试计算该项投资的收益率。 4. 某账户在年初的余额为100000;在5月1日余额为112000元,同时存入30000 元;到11月1日余额降为125000元,同时提取42000元;在下一年的1月1日又变为100000元。分别用资本加权法和时间加权法计算年收益率。 5. 票面值和赎回值都是1000元的2年期债券,每半年度支付一次的息票为2%, 而每半年度的收益率为1.5%。试构造摊还表。 6.设实际利率为6%,求下列资产的持续期限。 (1)5年期无息票债券;(2)息票率为4%的15年期债券(设票面值和赎回值相等);(3)15年期等额期末支付年金;(4)等额永久年金。 7. 某种零件的单位价格为20元,有效期为14年,残值为零,年利率为4%,现 希望将使用寿命延长8年,且年保养费用不变。问:可接受的价格上涨比例为多少? 《金融数学》课后习题参考答案 第三章 收益率 1、某现金流为:3000o o =元,11000o =元,12000I =元,24000I =元,求该现金流的收益率。 解:由题意得:2001122()()()0O I O I v O I v -+-+-= 23000100040000v v --= 4133v i ?=?= 2、某投资者第一年末投资7000元,第二年末投资1000元,而在第 一、三年末分别收回4000元和5500元,计算利率为0.09及0.1时的现金流现值,并计算该现金流的内部收益率。 解:由题意得:23(0)[(47) 5.5]1000V v v v =--+? 当0.09i =时,(0)75.05V = 当0.1i =时,(0)57.85V =- 令(0)00.8350.198V v i =?=?= 3、某项贷款1000元,每年计息4次的年名义利率为12%,若第一年后还款400元,第5年后还款800元,余下部分在第7年后还清,计算最后一次还款额。 解:由题意得:40.121(1)0.88854i v +=+?= 571000400800657.86v pv p =++?= 4、甲获得100000元保险金,若他用这笔保险金购买10年期期末付年金,每年可得15380元,若购买20年期期末付年金,则每年可得10720元,这两种年金基于相同的利率i ,计算i 。 解:由题意得: 08688.010720153802010=?=i a a i i 5、某投资基金按1(1)t k t k δ=+-积累,01t ≤≤,在时刻0基金中有10万 元,在时刻1基金中有11万元,一年中只有2次现金流,第一次在时刻0.25时投入15000元,第二次在时刻0.75时收回2万元,计算k 。 解:由题意得:101(1)1k dt t k e k +-?=+ 10.251(1)10.75k dt t k e k +-?=+ 10.751(1)10.25k dt t k e k +-?=+ ?10000(1)15000(10.75)20000(10.25)1100000.141176k k k k +++-+=?= 6、某投资业务中,直接投资的利率为8%,投资所得利息的再投资利率为4%,某人为在第10年末获得本息和1万元,采取每年末投资相等 的一笔款项,共10年,求证每年投资的款项为: 100.0410000 210s -。 证 明: 104%41100.041010000(())()(108%)104%210n j n j s n s p n i Is p n i p p j s - --+=+=+?=?=- 7.某投资人每年初在银行存款1000元,共5年,存款利率为5%,存款所得利息的再投资利率为4%,证明:V (11)=1250(0.04110.0461s s --)。 V(11)=1000[5(1+0.05)+0.05(Is)50.04][10.0560.04]S + 50.0451000[5.250.05][10.0560.04]0.04S S -=+?+ 8.甲年初投资2000元,年利率为 17%,每年末收回利息,各年收回的利息按某一利率又投资出去,至第10 年末,共得投资本息和76 第一章 利息的基本概念 1.)()0()(t a A t A = 2.11)0(=∴=b a 180)5(100=a ,508)8() 5(300=a a 3~5.用公式(1-4b) 7~9.用公式(1-5)、(1-6) 11.第三个月单利利息1%,复利利息23%)11(%)11(+-+ 12.1000)1)(1)(1(321=+++i i i k 14.n n n n i i i i --+?+>+++)1()1(2)1()1( 16.用p.6公式 17.用P .7最后两个公式 19.用公式(1-26) 20.(1)用公式(1-20); (2)用公式(1-23) 22. 用公式(1-29) 23.(1) 用公式(1-32);(2) 用公式(1-34)及题6(2)结论 24. 用公式(1-32) 25.4 42 1 6%1(1)(110%)118%45%12i ? ?+=++ ?-???? - ? ? ? 26.对于c)及d),δn e n a =)(,1 111)1(-=-= +==∴v d i e a δ ,∴c)中,v ln -=δ, d)中,δ --=e d 1 28.?=t dx x e t a 0)()(δ 29.4 411??? ? ?+=+j i ;h e j =+1 31.(1)902天 39.t e t A dr +=?10δ )1ln(0t dr t A +=?∴δ,两边同时求导,t t A += 11)(δ,)(t B δ类似 46.10009200.081000 d -= =,920)2 108.01(288)08.01(=? -+-x 第三章 收益率 2.解:2 3 4000 1.120000.93382?-?= 3.解:23 7000100040005500(0)v v v v v --++= 1.已知A (t)=2 +5,求 (1)对应的a(t );A (0)=5 a (t)=()(0)A t A =25t +5+1 (2)I 3;I 3=A(3)-A(2) -(2 (3)i 4; i 4=4(4)(3)(3) (3)I A A A A -=== 2.证明:(1)()()(m 1)(2).....A n A m I I m In -=+++++ (2)()(1)(1).A n in A n =+- (1) ()()()(1)(1)(2)....(1)()1...Im 1A n A m A n A n A n A n A m A m In In -=--+---++-=+-+++ (m 1.1 1. Sally has two IRAs. IRA 1 earns interest at 8% effective annually and IRA 2 earns interest at 10% effective annually. She has not made any contributions since January 1, 1985, when the amount in IRA 1 was twice the amount in IRA 2.The sum of the two accounts on January 1, 1993 was $75000. Determine how much was in IRA 2 on January 1, 1985? (Individual Retirement Account) 2. Suppose we are given that the effective rate of interest is 5% in the first year and 6% in the second year .We invest $1 at time 0. How much is in the fund at the end of two years? 3. An investor puts 100 into Fund X and 100 into Fund Y. Fund Y earns compound interest at the annual rate of j, and Fund X earns simple interest at the annual rate of 1.05j . At the end of 2 years, the amount in Fund Y is equal to the amount in Fund X. Calculate the amount in Fund Y at the end of 5 years? 4. Eric deposits X into a savings account at time 0, which pays interest at a nominal rate of i , compounded semiannually. Mike deposits 2X into a different savings account at time 0, which pays simple interest at an annual rate of i .Eric and Mike earn the same amount of interest during 利息理论第二章课后答案 1、 证明: () n m m n i v v a a -=-; 证明: 11()() m n n m m n i i i i v v v v a a -- -=-=- 2、化简:n t t n n a s a s -- 解: ()()()()()()()1 111 1111 1111111t n t n t t n t t n n n n n n i i i i i v i i i a s a s v i i n ------+=+=+=----+++++++ 3、设2,n n x y a a ==,用x 、y 来表示d; 解: ()()()2222221122111211n n n n n n v a x xi v x y i x y i xi yi i d i x x x y v yi v a y i ?-==??-=--????-=-?=?==??++---=??? ==?? 4、设,m n x y a s ??== 证明: 1m n vx y iy a ++= +; 证明: ()()()()()()111111111111m m m m n n n n v i a x v xiv xiv yi xv y i a i iy i s y v yi i -+-?-+?==?=----+?∴==?++-?==?=-??&&& & 5、证明:2322.. .. .. 1 .. .. .. n n n n n n s s s s s s + - =; 证明: ()()()()()()()()()() 2323222222111111 111111111111 11 n n n n n n n n n n n n n n n n s s s i i i s s s i i i i i i i +-+-+-+ -=+-+-+-+-??+-+?? =+++ =+-&&&&&&&&&&&& 6年金a 的给付情况是:1—10年,每年给付1000;11-20年,每年给付2000元;21-30年,每年给付1000元;年金b 在1-10年,每年给付k 元;11-20每年给付0;21-30,每年给付k 元,若a 与 b 相等,知道=0.5,计算k 解:100030a +10001010v a =k 30a -k 1010v a 又因10v =0.5 解答得k=1800 7 某人希望采取零存整取的方式累积2000,前n 年,每年末存入50,后n 年,每年末存入100,不足部分在2n+1年末存入,正好达到2000的存款本息和。设年利率为4.5%计算n 及超出或者不足2000的差额 解:50n s 2+50n s =2000 解答得n=9.3995 所以n=9 (5018s +509s )()i +1+x=2000 解答得 x=32.4 8 从1998年起,知道1998年底,默认每年一月一号和一月七号在银行存入一笔款项,七月一号的存款要比一月一号的多10.25%,并且与下一年的一月一号相等,每年计息两次且年名义利率为 学习课程:货币的时间价值与利息理论基础知识(试题答案) 单选题 1.将1万元人民币存入银行,两年后得到1万零300元,此时货币的时间价值是:回答:正确 1. A 10% 2. B 3% 3. C 30% 4. D 20% 2.下列关于货币时间价值的说法,正确的是:回答:正确 1. A 研究货币的时间价值要考虑风险和通货膨胀 2. B 研究的目的是对于现在的投入,将来可以回收多少资金 3. C 企业在研究投资项目时,可以不考虑社会平均利润率 4. D 是评价投资方案的标准之一 3.最典型的现金流量计算要包括:回答:正确 1. A 时间间隔长短 2. B 金额的高低 3. C 终值、现值和年金 4. D 投资回报率 4.张小姐在银行存入5万元,银行利率为5%,5年后取回,那么连本带利的终值是:回答:正确 1. A 577881 2. B 59775 3. C 55125 4. D 63814 5.下列关于单利和复利的表述,正确的是:回答:正确 1. A 对于较长时间的存款,复利可以比单利产生更大的终值 2. B 单利俗称“利滚利” 3. C 在单个度量期内,单利和复利的终值不相同 4. D 复利在同样长时期增长的绝对金额为常数 6.已知年利率为15%,按季计息,则有效年利率比名义年利率高:回答:正确 1. A 15.86% 2. B 0.86% 3. C 1.07% 4. D 10.07% 7.某投资者希望两年后有一笔价值100000元的存款,假设年收益率为20%,则现在该投资者应该投入: 回答:正确 1. A 60000元 2. B 65000元 3. C 69444元 4. D 72000元 8.投资翻倍的72定律得到的只是一个近似结果,如果想要结果比较准确,则要求利率保持在:回答:正确 1. A 2%—20% 2. B 20%—40% 3. C 36%以下 4. D 72%以上 9.年金按照起讫日期可以划分为:回答:错误 1. A 期末年金和期初年金 《利息理论》习题详解 第一章 、利息的基本概念 1、解: (1))()0()(t a A t A =Θ 又()25A t t =+Q (0)5 ()2()1(0)55 A A t a t t A ∴===++ (2 )3(3)(2)11(92 2.318I A A =-=== (3 )4(4)(3)0.178(3)A A i A -= == 2、解: 202()(0)(1)1(1-6) 180=100(a 5+1) 4 a=125a t at b a b i =+∴==+=∴∴Q g 用公式 (8)300(83)386.4A a ∴=-= 3、解: 15545(4)(3)(1)100(10.04)0.05 5.2 n n n I i A I A i A i i -=∴==+=+?=Q 4、解: (1)1n n n I i A -= Q 113355(1)(0)1101000.1(0)(0)100 (3)(2)1301200.0833(2)(2)120 (5)(4)1501400.0714(4)(4)140 I A A i A A I A A i A A I A A i A A --∴====--====--==== (2)1n n n I i A -= Q 113355(1)(0)1101000.1(0)(0)100 (3)(2)133.11210.1(2)(2)121 (5)(4)161.051146.410.1(4)(4)146.41 I A A i A A I A A i A A I A A i A A --∴====--====--==== 5、证明: (1) 123(1)() (2)(1) (3)(2) ()(1) m m m m k I A m A m I A m A m I A m A m I A m k A m k ++++=+-=+-+=+-+=+-+-Q M 123123()() ()()()m m m m k m m m n I I I I A m k A m n m k A n A m I I I I m n +++++++∴++++=+-=+-=++++利息理论第四章课后答案

2010利息理论试题(A)

利息理论第一章课后答案

货币的时间价值与利息理论基础知识 课后测试

金融数学(利息理论)复习题练习题

利息理论答案

利息理论第四章课后标准答案

《利息理论》试题(B)

《利息理论》考试试题(B卷)参考答案

利息理论试卷

利息理论第三章课后标准答案

刘占国《利息理论》第一章、第三章习题答案与提示

利息理论第一章课后标准答案

利息理论习题

利息理论第二章课后答案

学习课程:货币的时间价值与利息理论基础知识(试题答案)

《利息理论》刘占国版习题详细解答