Is High-Frequency Trading Inducing Changes in Market Microstructure and Dynamics

Is high-frequency trading inducing changes in market microstructure and dynamics?

Reginald Smith

PO Box10051,Rochester,NY14610

E-mail:rsmith@https://www.wendangku.net/doc/5f9397766.html,

https://www.wendangku.net/doc/5f9397766.html,ing high-frequency time series of stock prices and share volumes

sizes from January2002-May2009,this paper investigates whether the e?ects of

the onset of high-frequency trading,most prominent since2005,are apparent in

the dynamics of the dollar traded volume.Indeed it is found in almost all of14

heavily traded stocks,that there has been an increase in the Hurst exponent of

dollar traded volume from Gaussian noise in the earlier years to more self-similar

dynamics in later years.This shift is linked both temporally to the Reg NMS

reforms allowing high-frequency trading to?ourish as well as to the declining

average size of trades with smaller trades showing markedly higher degrees of

self-similarity.

Keywords:?nancial markets,algorithmic trading,self-similarity,wavelets,high frequency trading,Hurst exponent

1.Introduction

Over the last couple of decades,cheap computing power and improved telecommunications have all but obsoleted to old style open-cry auctions which drove equity markets for centuries.This change has occurred so rapidly,that it has disrupted the traditional dominance of the exchanges,brought into?nance new strategies such as statistical arbitrage,and fuelled intense public and regulatory debate over the positive bene?ts and costs of the new world of electronic trading.

One of the largest e?ects of this movement has been the disruption of and controversy about old paradigms such as assumed normal distributions of asset returns and the absence of long-term persistence in price?uctuations that random walk models dictate.However,recent advances in data analysis techniques and recent?nancial market turbulence may provide a fertile proving ground for research that improves both a theoretical and empirical understanding of?nancial market dynamics.

The?eld of research which has likely attracted some of the largest attention and literature in quantitative?nance and econophysics Mantegna and Stanley(1999); Tsay(2002)is likely the research of the movements by asset prices and volumes in trading on?nancial markets.This is for several reasons.First,the data,which are fundamentally time series amongst correlated systems,are amenable to the well-developed techniques from econometrics,physical research,and applied mathematics and statistics.Second,large datasets are easily and cheaply available,sometimes for free,as in the case of daily closing https://www.wendangku.net/doc/5f9397766.html,bined with cheap computing power,there is a low barrier to entry for participants eager to apply many well-known techniques to price dynamics of stocks,currencies,or other widely traded assets.

A common theme in this research has often been the investigation of self-similarity and long-range dependence in the time series.The former is often measured by the Hurst exponent,H,which measures the relative degree of self-similarity from pure Markovian Browninan motion at H=0.5to complete self-similarity at H=1.A value of0.5

This paper is organized as follows.First,a brief introduction to the history of ?nancial markets in the in the US will be given which culminates in the reforms of the late20th and early21st century which enabled high frequency trading.Next,the

Acronym Meaning

ATS Alternative trading system

ECN Electronic communication network

HFT High-frequency trading

NASD National Association of Securities Dealers

NASDAQ National Association of Securities Dealers Automated Quotations NBBO National Best Bid and O?er

NYSE New York Stock Exchange

OTC Over-the-counter

Reg ATS Regulation Alternative Trading System

Reg NMS Regulation National Market System

SEC Securities&Exchange Commission

TAQ NYSE Trades and Quotes Database

Table1.Acronym Guide

data sources and mathematical methods used to analyze the time series self-similarity will be introduced and explained.Finally the results of the analysis,possible causes, and a brief conclusion will close out the paper.

2.A brief history of the events leading up to high frequency trading

In1792,as a new nation worked out its new constitution and laws,another less heralded revolution began when several men met under a Buttonwood tree,and later co?ee houses,on Wall St.in New York City to buy and sell equity positions in ?edgling companies.An exclusive members club from the beginning,the New York Stock Exchange(NYSE)rapidly grew to become one of the most powerful exchanges in the world.Ironically,even the non-member curbside traders outside the co?ee houses gradually evolved into over-the-counter(OTC)traders and later,the NASDAQ.A very detailed and colorful history of this evolution is given in Markham and Harty (2008);Harris(2003).

Broadly,the role of the exchange is to act as a market maker for company stocks where buyers with excess capital would like to purchase shares and sellers with excess stock would like to liquidate their position.Several roles developed in the NYSE to encourage smooth operation and liquidity.There came to be several types of market makers for buyers and sellers known as brokers,dealers,and specialists.The usual transaction involves the execution of a limit order versus other o?ers.A limit order,as contrasted to a market order which buys or sells a stock at the prevailing market rate, instructs the purchase of a stock up to a limit ceiling or the sale of a stock down to a limit?oor.Brokers act on behalf of a third-party,typically an institutional investor, to buy or sell stock according to the pricing of the limit order.Dealers,also known as market-makers,buy and sell stock using their own capital,purchasing at the bid price and selling at the ask price,pocketing the bid-ask spread as pro?t.This helps ensure market liquidity.A specialist acts as either a broker or dealer but only for a speci?c list of stocks that he or she is responsible for.As a broker,the specialist executes trades from a display book of outstanding orders and as a dealer a specialist can trade on his or her own account to stabilize stock prices.

The great rupture in the business-as-usual came with the Great Depression and

the unfolding revelations of corrupt stock dealings,fraud,and other such malfeasance. The Securities and Exchange Commission(SEC)was created by Congress in1934by the Securities Exchange Act.Since then,it has acted as the regulator of the stock exchanges and the companies that list on them.Over time,the SEC and Wall Street have evolved together,in?uencing each other in the process.

By the1960s,the volume of traded shares was overwhelming the traditional paper systems that brokers,dealers,and specialists on the?oor used.A“paperwork crisis”developed that seriously hampered operations of the NYSE and led to the ?rst electronic order routing system,DOT by1976.In addition,ine?ciencies in the handling of OTC orders,also known as“pink sheets”,led to a1963SEC recommendation of changes to the industry which led the National Association of Securities Dealers(NASD)to form the NASDAQ in1968.Orders were displayed electronically while the deals were made through the telephone through“market makers”instead of dealers or specialists.In1975,under the prompting of Congress, the SEC passed the Regulation of the National Market System,more commonly known as Reg NMS,which was used to mandate the interconnectedness of various markets for stocks to prevent a tiered marketplace where small,medium,and large investors would have a speci?c market and smaller investors would be disadvantaged. One of the outcomes of Reg NMS was the accelerated use of technology to connect markets and display quotes.This would enable stocks to be traded on di?erent, albeit connected,exchanges from the NYSE such as the soon to emerge electronic communication networks(ECNs),known to the SEC as alternative trading systems (ATS).

In the1980s,the NYSE upgraded their order system again to SuperDot.The increasing speed and availability computers helped enable trading of entire portfolios of stocks simultaneously in what became known as program trading.One of the?rst instances of algorithmic trading,program trading was not high-frequency per se but used to trade large orders of multiple stocks at once.Program trading was pro?table but is now often cited as one of the largest factors behind the1987Black Monday crash.Even the human systems broke down,however,as many NASDAQ market makers did not answer the phones during the crash.

The true acceleration of progress and the advent of what is now known as high frequency trading occurred during the1990s.The telecommunications technology boom as well as the dotcom frenzy led to many extensive changes.A new group of exchanges became prominent.These were the ECN/ATS https://www.wendangku.net/doc/5f9397766.html,ing new computer technology,they provided an alternate market platform where buyers and sellers could have their orders matched automatically to the best price without middlemen such as dealers or brokers.They also allowed complete anonymity for buyers and sellers.One issue though was even though they were connected to the exchanges via Reg NMS requirements,there was little mandated transparency.In other words,deals settled on the ECN/ATS were not revealed to the exchange.On the ?ip side,the exchange brokers were not obligated to transact with an order displayed from an ECN,even if it was better for their customer.

This began to change,partially because of revelations of multiple violations of ?duciary duty by specialists in the NYSE.One example,similar to the soon to be invented‘?ash trading’,was where they would“interposition”themselves between their clients and the best o?er in order to either buy low from the client and sell higher to the NBBO(National Best Bid and O?er;the best price)price or vice versa.In1997, the SEC passed the Limit Order Display rule to improve transparency that required

market makers to include o?ers at better prices than those the market maker is o?ering to investors.This allows investors to know the NBBO and circumvent corruption. However,this rule also had the e?ect of requiring the exchanges to display electronic orders from the ECN/ATS systems that were better priced.The SEC followed up in 1998with Regulation ATS.Reg ATS allowed ECN/ATS systems to register as either brokers or exchanges.It also protected investors by mandating reporting requirements and transparency of aggregate trading activity for ECN/ATS systems once they reach a certain size.

These changes opened up huge new opportunities for ECN/ATS systems by allowing them to display and execute quotes directly with the big exchanges.Though they were required to report these transactions to the exchange,they gained much more.In particular,with their advanced technology and low-latency communication systems,they became a portal through which next generation algorithmic trading and high frequency trading algorithms could have access to wider markets.Changes still continued to accelerate.

In2000,were two other groundbreaking changes.First was the decimalization of the price quotes on US stocks.This reduced the bid-ask spreads and made it much easier for computer algorithms to trade stocks and conduct arbitrage.The NYSE also repealed Rule390which had prohibited the trading of stocks listed prior to April26, 1979outside of the exchange.High frequency trading began to grow rapidly but did not truly take o?until2005.

In June2005,the SEC revised Reg NMS with several key mandates.Some were relatively minor such as the Sub-Penny rule which prevented stock quotations at a resolution less than one cent.However,the biggest change was Rule611,also known as the Order Protection Rule.Whereas with the Limit Order Display rule,exchanges were merely required to display better quotes,Reg NMS Rule611mandated,with some exceptions,that trades are always automatically executed at the best quote possible.Price is the only issue and not counterparty reliability,transaction speed, etc.The opening for high frequency trading here is clear.The automatic trade execution created the perfect environment for high speed transactions that would be automatically executed and not sit in a queue waiting for approval by a market maker or some vague exchange rule.The limit to trading speed and pro?t was now mostly the latency on electronic trading systems.

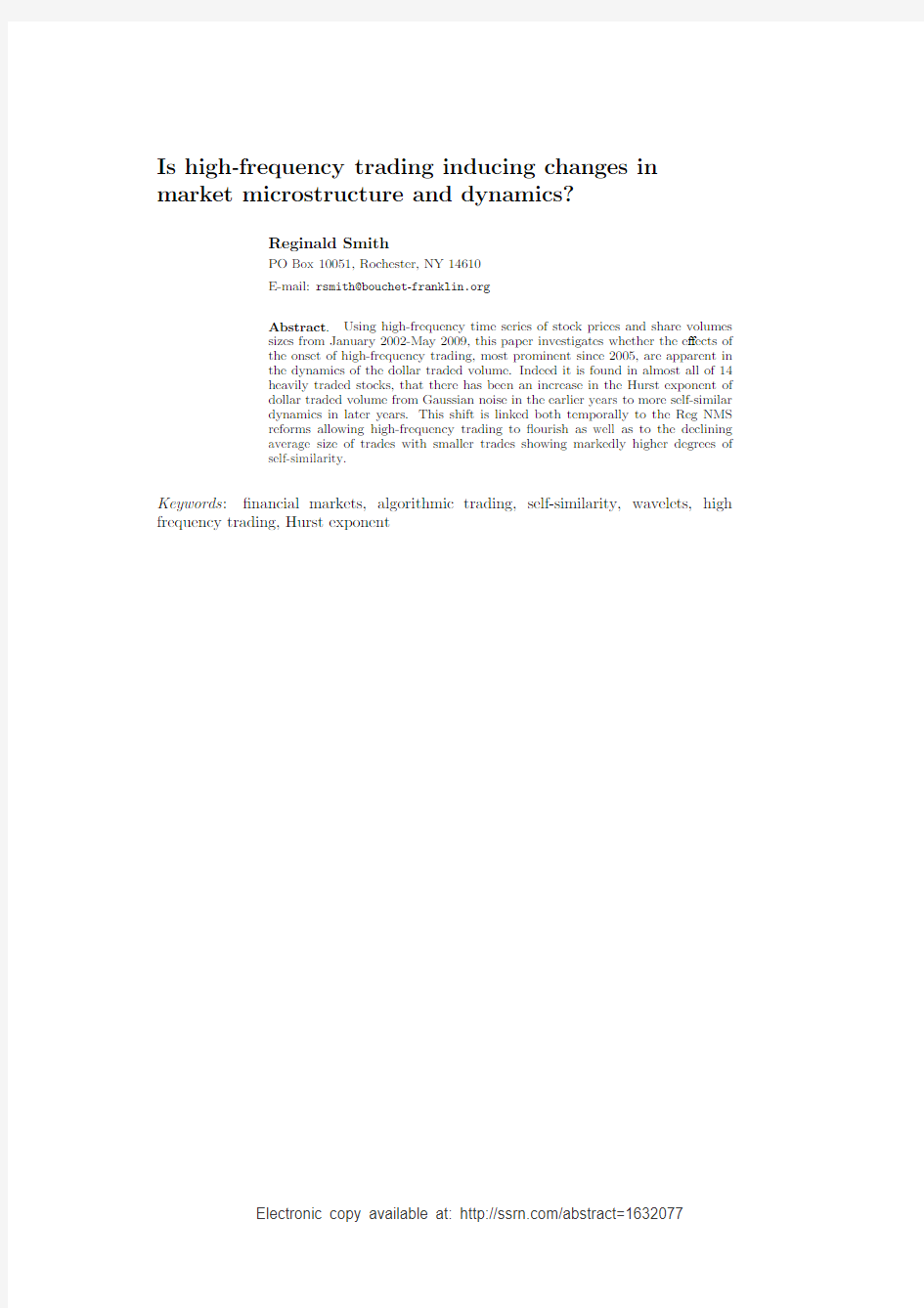

The boom in ECN/ATS business created huge competition for exchanges causing traditional exchanges(NYSE&Euronext)to merge and some exchanges to merge with large ECNs(NYSE&Archipelago).In addition,the competition created increasingly risky business strategies to lure customers.CBSX and DirectEdge pioneered‘?ash trading’on the Chicago Board of Exchange and the NYSE/NASDAQ respectively where large limit orders would be?ashed for50milliseconds on the network to paying customers who could then rapidly trade in order to pro?t from them before public advertisement.Many of these were discontinued in late2009after public outcry but HFT was already the dominant vehicle for US equity trading as shown in?gure1.

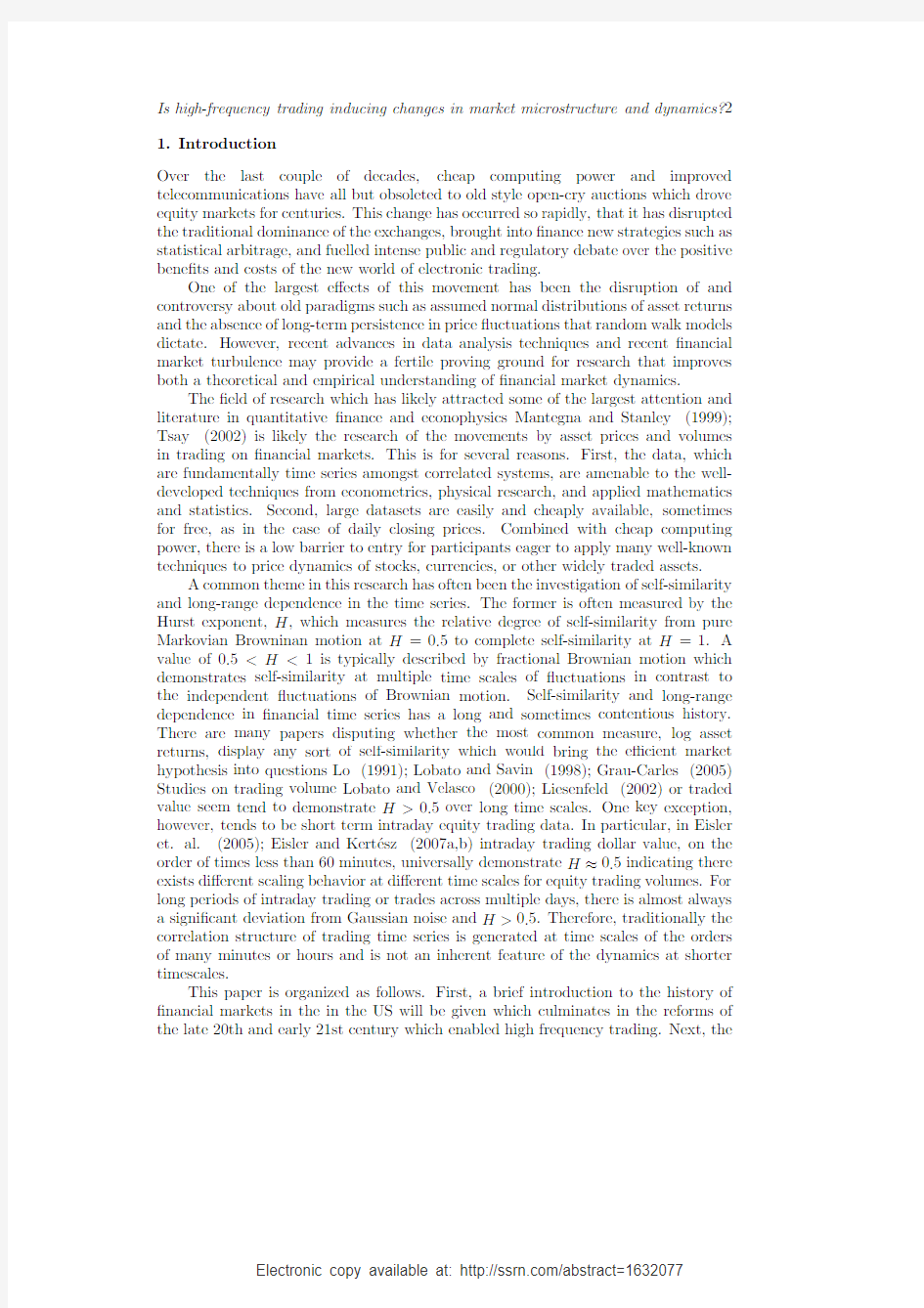

HFT thrives on rapid?re trading of small sized orders and the overall shares/trade has dropped rapidly over the last few years is shown in?gure2.In addition,the HFT strategy of taking advantage of pricing signals from large orders has forced many orders o?exchanges into proprietary trading networks called‘dark pools’which get their name from the fact they are private networks which only report the prices of transactions after the transaction has occurred and typically anonymously match large orders without price advertisements.These dark pools allow a safer environment for

2005

2006200720082009

2040608010

Figure 1.The proportion of all US equity trading carried out through high frequency trading.Source:Tabb Group

20022003200420052006200720082009

5001000150020002500300

02002

2003200420052006200720082009

5001000150020002500300

Figure 2.A graph showing the average size of a trade in shares over the period from 2002-May 2009where data for this paper is used.The left image is for stocks on the NYSE and the right image is for stocks on the NASDAQ.The corresponding stocks for the NYSE/NASDAQ for each color are:red,PG/MSFT,blue,BAC/AAPL,grey,C/GENZ,green,CHD/GILD,orange,GE/NWS,black,ITT/INTC,light blue,PFE/CSCO.The spikes in shares/trade for both Citigroup and Bank of America in early 2009are due to emergency injections of capital by the US government.In Citigroup’s case,this was done by converting bonds held by the US Treasury into stock.

Figure3.The rough timeline of the events spanning decades that led to the

current market penetration of high-frequency trading.

large trades which(usually)keep out opportunistic high frequency traders.The basic structure of today’s market and a timeline of developments are given in?gure3and ?gure4.For more detailed information,see Stoll(2006);McAndrews and Stefandis (2000);Francis et.al.(2009);Mittal(2008);Degryse et.al.(2008);Palmer(2009) 3.Data Sources and Analysis Methods

In this paper,we will follow up on the research previously done in Eisler et.al.(2005); Eisler and Kert′e sz(2007a,b)and describe changes in the high-frequency(short period) structure of the equity trading markets that likely have been induced by the spread of HFT?rms and strategies.In particular,this paper will demonstrate,that since2005 there has been a marked changed in the correlation structure of stock trading dynamics where amongst many stocks,there has been a measurable departure from the typical H=0.5regime and that stronger self-similarity has been steadily increasing over the

Figure4.A basic overview of the current major venues for the trading of US

equities.

same period in the time that HFT has become the largest source of market volume.

The data in this paper uses the daily intraday trading records of14US stocks, 7from the NYSE and7from the NASDAQ,from the NYSE Trades and Quotes (TAQ)database accessed through Wharton Research Data Services(WRDS).The stocks used are listed in table2.These stocks were chosen for being both relatively liquid(high daily trading volumes)and also representing a variety of industries.Time series of all intraday trades occurring from0930to1600EST were gathered over the period January1,2002to May31,2009.The TAQ database is comprehensive in coverage of trades settled through the NYSE and NASDAQ which includes trades transacted by exchanges with ECNs.However,the TAQ data does not cover private ECN transactions not settled with the exchanges nor the information from trades in dark pools.Thus it provides a good,but not complete,view of the market and HFT.In addition,sale condition codes and trade correction indicators corresponding to invalid trades were removed.Trades with sale condition codes of(B,D,G,J,K,L,M,N,

Quote Symbol Stock Name

BAC Bank of America

C Citicorp

PG Proctor&Gamble

GE General Electric

ITT ITT Industries

CHD Church&Dwight

PFE P?zer

MSFT Microsoft

INTC Intel

CSCO Cisco

GENZ Genzyme

GILD Gilead Sciences

AAPL Apple Computer Inc.

NWS News Corp.

Table2.Quote symbols and stocks discussed in this paper.

O,P,Q,R,T,U,W,Z,4(NASDAQ),6(NASDAQ)),trade correction indicators not equal of0,1,or2,or negative share sizes or prices were excluded from calculations by the algorithm.

Following techniques from Eisler et.al.(2005);Eisler and Kert′e sz(2007a,b), the measured variable is the traded value per unit time where the traded value V i(n) for a stock i in transaction n is de?ned as

V i(n)=p i(n)S i(n)(1) where p i(n)is the price the trade is executed at and S i(n)is the share size of the trade.The traded value per unit time?t is de?ned as

f?t i (t)=

n,t i(n)∈[t,t+?t]

V i(n)(2)

The trade data had a resolution of1second and trades were aggregated into 1second buckets for analysis of the time series.Each trading day was analyzed independently and data was not combined across days.The?rst step was a brief analysis to investigate the presence or absence of HFT via average share sizes over the measured period.For all selected stocks,there was a marked decrease in the average number of shares per trade shown collectively in?gure2.This decrease in trade size was used as prima facie evidence of the in?uence of HFT on the selected stocks.Next to be addressed was whether the short-term correlation structure of intraday stock trading has been signi?cantly a?ected by HFT and related strategies. All previous papers,and data pulled from NYSE TAQ on stocks in1993by the author, indicate that short-term correlations were traditionally largely absent from the trading patterns,consistently showing an average H≈0.5.

In order to fully investigate the structure of intraday trading over several time scales at many orders of magnitude,a discrete wavelet transform was used to create a logscale diagram to observe the behavior of the second moment of the detailed wavelet coe?cients across multiple octaves representing di?erent time scales.A brief overview of the wavelet analysis is given in the appendix and the logscale diagram in described in the next section.

4.Discrete wavelet transforms and logscale diagrams

Wavelets were chosen to understand the data for a variety of reasons.First, common methods used to measure the Hurst exponent such as rescaled range analysis (R/S statistic)or aggregated variance analysis are built around an assumption of stationarity in the data.This assumption is not valid for intraday stock time series since there is a well-known and marked non-stationarity including peaks of activity at the beginning and end of the day and a dip during lunch time.R/S scaling has also been shown to introduce distortions in the measurement of the Hurst exponent in ?nancial time series Couillard and Davison(2005).Second,some common methods to analyze the correlation structure of nonstationary data such as detrended?uctuation analysis(DFA)have been found to systematically introduce errors in measurements of the Hurst exponent except in the case of simple monotonic trends Bardet and Kammoun(2008).

The mathematical preliminaries of wavelets and the logscale diagrams will be skipped here but shown in the appendix.The analysis here follows the detailed methodology of Abry,Flandrin,Taqqu,&Veitch Abry et.al.(2000,2003).This analysis uses a discrete wavelet transformation(DWT)over14octaves using the Haar wavelet.The detailed coe?cients d X(j,k)for each octave,j,and time slice2j k were used to calculate the second moment of the coe?cients for each octave following the equation

S2(j)=1

n j

k

|d X(j,k)|2(3)

The logscale diagram is then created by plotting y j=log2S j(j)vs.j using a logarithm of base2.The subsequent step is to analyze the logscale diagrams for each stock in a variety of time periods to identify characteristic trends.As stated in the appendix,the presence of self-similar behavior representing H>0.5is indicated by a positive linear slope across multiple octaves.This scale-invariant(here scale is over di?erent time scales)behavior is a key feature of self-similarity.As a guide,a minimum trend of three points is necessary to unambiguously characterize self-similar behavior across multiple time scales Abry et.al.(2000,2003).

The logscale diagrams for the intraday time?uctuations of total value all seem to show common features as seen in?gure5.One can distinguish biscaling behavior over two di?erent time scales.On the high frequency end,octaves j∈[1,10],there is a relatively?at trend,especially in the earliest years.Given that the Hurst exponent is related to the slopeαof the logscale diagram by

H=α+1

2

(4)

a?at slope indicates H=0.5and normal Brownian motion.At j∈[10,11]there is usually a transition,often involving a decrease in y j and then another,steeper, positive trend over the next couple of octaves though there is sometimes a dip at j=14,possibly due to boundary e?ects of the signal size.There are two key features of this second,low-frequency region of greater than211seconds(about34minutes). First,it seems to represent correlations that appear over substantial periods of time in the trading day from many minutes to hours.Second,it is present over all years with data including all the way back to1993.This seems to indicate that this is a long-extant feature of the intraday stock trading dynamics and not a new manifestation of

2468101214

30323436384

Figure 5.Typical logscale diagram.Average of octave values for PG over 2005.Error bars represent the 95%con?dence intervals for each octave.

behavior.With greater resolution data,we would like be able to robustly calculate a Hurst exponent H >0.5for this region over all years.This ?nding does not contradict earlier work that showed an exponent of H ≈0.5for traded value during a trading day since the previous research only looked at intraday time scales under 60minutes which would not resolve these features Eisler et.al.(2005);Eisler and Kert′e sz (2007a,b).The last thirty seconds of trading were excluded from the NASDAQ time series since on some days huge spikes in share trading and the ending of trading often skewed the wavelet coe?cients and distorted logscale diagrams despite trading throughout the day following the traditional pattern.

4.1.Logscale diagrams and Hurst exponent estimation

Therefore,the focus of any search for the e?ects of recent HFT should be focused on the high frequency region from octaves 1-10.A simple unbiased method of calculating the slope of the logscale diagram in this region would be least-squares regression,however,it is more advisable to use the method of Abry et.al.(2000,2003)where

a weighted regression that weights each S 2(j )by its variances σ2

j to calculate the minimum variance unbiased estimator correcting for heteroscedasticity.

The estimator ?αfor αover an octave range j ∈[j 1,j 2]is given by

?α= j y j (Sj ?S j )/σ2j SS jj ?S 2j

≡ j

w j y j (5)where the variance σ2

j is de?ned as

σ2j =

ζ(2,n j /2)

ln 22

(6)

Where ζ(z,v )is a generalized Riemann Zeta function and n j is the number of detailed coe?cients in the octave j .Note that the variance depends only on the number of coe?cients and not the details of the data.

The additional variables are de?ned S=

[j1,j2]

(1/σ2j),S j=

[j1,j2]

(j/σ2j)and

S jj=

[j1,j2]

(j2/σ2j).Note the S variables must be calculated before the summation

in the full estimator equation.Additionally,the variance of?αis given by

V ar(?α)=

j

σ2j w2j(7)

The distribution of?α,can be considered approximately Gaussian and using two standard deviations for95%con?dence intervals,the95%con?dence interval of?α±0.02and given equation4,the95%con?dence interval of calculated daily H is ±0.01.

5.Results of wavelet analysis

Calculations of H according to the above methodology were done for each stock on each day over the time periods of the data.In order to more easily visualize trends, H was averaged over each month and plotted over time from January2002to May 2009.The following pages show the?gures for monthly averages of the trends for each stock over time with95%con?dence intervals,given the range of measured H over the month,given by dashed lines.The two vertical solid lines give the passing of the Reg NMS changes and their?rst implementation deadline respectively.

The?rst clear feature is a trend across all stocks for the time periods shown. For the NYSE stocks,the Hurst exponents increase from2002onward but by late 2005barely break the average of H=0.55.Therefore,during this time(and before), short term trading?uctuations do not appreciably depart from an approximation of Gaussian white noise.However,once Reg NMS is implemented the structure of the trading noise begins to change rapidly increasing to0.6and beyond in a couple of years.This is a new behavior in the high-frequency spectrum of trading data that indicates increasingly correlated trading activity over increasingly shorter timescales over the last several years.Correlations previously only seen across hours or days in trading time series are increasingly showing up in the timescales of seconds or minutes.

A more complicated picture is shown in the NASDAQ data.The Hurst exponent of NASDAQ stocks started rising much earlier,from2002or earlier.By the time Reg NMS was passed,most NASDAQ stocks already had an H which many stocks on the NYSE would not reach until2009.Some NASDAQ stocks,such as AAPL or CSCO,did have spikes shortly after the new rules went into e?ect but soon returned to normal behavior.In fact,data from Figure10shows this spike for AAPL was likely not due to HFT as it was most pronounced amongst larger sized trades.It is probable that since NASDAQ was one of the?rst exchanges to embrace electronic trading and experience HFT via ECNs,the rules o?cially unchaining HFT for other exchanges from2005was close to a non-event.Possibly,because HFT was experienced earlier, there is not as dramatic a rise from the time of Reg NMS in H for NASDAQ.The one marked change from the implementation time of Reg NMS is the emergence of massive share trades at the?nal seconds of trading days,sometimes varying over many orders of magnitude by day,that required the time series to remove to get clear data.

In order to more clearly understand the source of the increased self-similarity in the trading noise,the data was analyzed again in buckets corresponding to trades of a certain size.In all cases it was found that the H of trades where the average shares/trade was greater than about1500shares had an H≈0.5for all time periods while H>0.5for trades with an average of less than1500shares per trade.The

0.500.520.540.560.580.600.620.640.660.680.70

20022003200420052006200720082009

2002

2003200420052006200720082009

0.500.520.540.560.580.600.620.640.660.680.70

20022003200420052006200720082009

0.500.520.540.560.580.600.620.640.660.680.70

0.500.520.540.560.580.600.620.640.660.680.70

2002

2003200420052006200720082009

20022003200420052006200720082009

0.500.520.540.560.580.600.620.640.660.680.70

2002

2003200420052006200720082009

0.500.520.540.560.580.600.620.640.660.680.70

Figure 6.The average Hurst exponent by month over the time period of 2002-May 2009as calculated using the wavelet coe?cient method.The blue line represents the average value while the dotted lines above and below represent the 95%con?dence interval of values during each month.The two black vertical lines represent ?rst the promulgation of Reg NMS by the SEC in June 2005and the ?rst implementation compliance date of June 2006.Stocks in each row are paired by NYSE/NASDAQ:Bank of America (BAC)/Microsoft (MSFT),Citigroup (C)/Intel (INTC),Proctor &Gamble (PG)/Cisco Systems (CSCO)).

0.500.520.540.560.580.600.620.640.660.680.70

20022003200420052006200720082009

0.500.520.540.560.580.600.620.640.660.680.70

2002

2003200420052006200720082009

20022003200420052006200720082009

0.500.520.540.560.580.600.620.640.660.680.70

2002

2003200420052006200720082009

0.500.520.540.560.580.600.620.640.660.680.70

20022003200420052006200720082009

0.500.520.540.560.580.600.620.640.660.680.70

0.500.520.540.560.580.600.620.640.660.680.70

2002

2003200420052006200720082009

Figure 7.The average Hurst exponent by month over the time period of 2002-May 2009as calculated using the wavelet coe?cient method.The blue line represents the average value while the dotted lines above and below represent the 95%con?dence interval of values during each month.The two black vertical lines represent ?rst the promulgation of Reg NMS by the SEC in June 2005and the ?rst implementation compliance date of June 2006.Stocks in each row are paired by NYSE/NASDAQ:General Electric (GE)/Apple Computer (AAPL),ITT Industries (ITT)/Genzyme (GENZ),Church &Dwight (CHD)/Gilead Sciences (GILD).

0.500.520.540.560.580.600.620.640.660.680.70

20022003200420052006200720082009

2002

2003200420052006200720082009

0.500.520.540.560.580.600.620.640.660.680.70

Figure 8.The average Hurst exponent by month over the time period of 2002-May 2009as calculated using the wavelet coe?cient method.The blue line represents the average value while the dotted lines above and below represent the 95%con?dence interval of values during each month.The two black vertical lines represent ?rst the promulgation of Reg NMS by the SEC in June 2005and the ?rst implementation compliance date of June 2006.Stocks in each row are paired by NYSE/NASDAQ:P?zer (PFE)/News Corp.(NWS).

results are shown for several stocks in the ?rst columns of ?gures 9and 10.It shows that over all time periods,trades with smaller share sizes show a higher H than trades with larger share sizes.The relative di?erence does not change appreciably over time.Trades with more than 1500shares per trade are relatively moribund and do not usually depart from H ≈0.5.However,as the trade sizes decrease,especially to 1500shares or below,there is a high level of correlation in the trading activity.The relative activity of each of these trade sizes stays relatively proportional over time.

Therefore,stock trading noise as measured here can be determined to be a superposition of two types of noise.For large share trades,the noise is approximately Gaussian white noise,while for small share trades the noise has a more fractal character.So if the relative H for share trade sizes stays relatively constant over time why does the overall H increase?The answer is illustrated in the second column of ?gures 9and 10which shows how over time,and especially since the boom of widespread HFT,the proportion of all trades by the small share trades has increased markedly.Therefore,we can determine the increasing H of overall stock trading noise is generated by a larger relative proportion of trading by small share trades generated primarily through HFT.The dynamics of HFT and non-HFT trading have not altered much,but their relative magnitude has changed dramatically.

0.5

0.60.70.82002200320042005200620072008

2009

0.0

0.10.20.30.40.50.60.70.80.91.0

2002

200320042005200620072008

2009

0.5

0.60.70.82002200320042005200620072008

2009

2002

2003200420052006200720082009

0.0

0.10.20.30.40.50.60.70.80.91.

Figure 9.Each row of images shows the average Hurst exponent by month for a range of trade sizes in the ?rst image.The second image is the relative proportion of all trades by that trade size range.Row by row are,Bank of America (BAC)and General Electric (GE).The color lines indicate the range of shares per trade analyzed:blue is 1500+shares per trade,green is 750-1000shares per trade,orange is 250-500shares per trade,and red is less than 250shares per trade.

20022003200420052006200720082009

0.5

0.60.70.

80.0

0.10.20.30.40.50.60.70.80.91.0

2002

200320042005200620072008

2009

2002200320042005200620072008

2009

0.5

0.60.70.80.0

0.10.20.30.40.50.60.70.80.91.0

2002

200320042005200620072008

2009

Figure 10.Each row of images shows the average Hurst exponent by month for a range of trade sizes in the ?rst image.The second image is the relative proportion of all trades by that trade size range.Row by row are Intel Corp.(INTC)and Apple Computer (AAPL).The color lines indicate the range of shares per trade analyzed:blue is 1500+shares per trade,green is 750-1000shares per trade,orange is 250-500shares per trade,and red is less than 250shares per trade.

In a ?nal check for true self-similarity,the data was analyzed again where the 1s buckets in each day were randomly shu?ed.In each case,the correlation structure of the time series was destroyed and H ≈0.5for all times from 2002-May 2009.

6.Possible causes of self-similarity

Given the complex nature of HFT trades and the frequent opacity of?rm trading strategies,it is di?cult to pinpoint exactly what about HFT causes a higher correlation structure.One answer could be that HFT is the only type of trading that can exhibit trades that are reactive and exhibit feedback e?ects on short timescales that traditional trading generates over longer timescales.

Another cause may be the nature of HFT strategies themselves.Most HFT strategies can fall into two buckets Lehoczky and Schervish(2009):

(i)Optimal order execution:trades whose purpose is to break large share size trades

into smaller ones for easier execution in the market without a?ecting market prices and eroding pro?t.There are two possibilities here.One that the breaking down of large orders to smaller ones approximates a multiplicative cascade which can generate self-similar behavior over time Mandelbrot(1974).Second,the queuing of chunks of larger orders under an M/G/∞queue could also generate correlations in the trade?ow.However,it is questionable whether the“service time”,or time to sell shares in a limit order,is a distribution with in?nite variance as this queuing model requires.

(ii)Statistical arbitrage:trades who use the properties of stock?uctuations and volatility to gain quick pro?ts.Anecdotally,these are most pro?table in times of high market volatility.Perhaps since these algorithms work through measuring market?uctuations and reacting on them,a complex system of feedback based trades could generate self-similarity from a variety of yet unknown processes. Since?rm trade strategies are carefully guarded secrets,it is di?cult to tell which of these strategies predominate and induces most of the temporal correlations.

7.Conclusion

Given the above research results,we can clearly demonstrate that HFT is having an increasingly large impact on the microstructure of equity trading dynamics.We can determine this through several main pieces of evidence.First,the Hurst exponent H of traded value in short time scales(15minutes or less)is increasing over time from its previous Gaussian white noise values of0.5.Second,this increase becomes most marked,especially in the NYSE stocks,following the implementation of Reg NMS by the SEC which led to the boom in HFT.Finally,H>0.5traded value activity is clearly linked with small share trades which are the trades dominated by HFT tra?c. In addition,this small share trade activity has grown rapidly as a proportion of all trades.The clear transition to HFT in?uenced trading noise is more easily seen in the NYSE stocks than with the NASDAQ stocks except NWS.The main exceptions seem to be GENZ and GILD in the NASDAQ which are less widely traded stocks.There are values of H consistently above0.5but not to the magnitude of the other stocks. The electronic nature of the NASDAQ market and its earlier adoption of HFT likely has made the higher H values not as recent a development as in the NYSE,but a development nevertheless.

Given the relative burstiness of signals with H>0.5we can also determine that volatility in trading patterns is no longer due to just adverse events but is becoming an increasingly intrinsic part of trading activity.Like internet tra?c Leland et.al. (1994),if HFT trades are self-similar with H>0.5,more participants in the market

generate more volatility,not more predictable behavior.The probability of a traded value greater than V in any given time can be given by

P[v≥V]~h(v)v?α(8) where h(v)is a function that slowly varies at in?nity and0<α<2.The Hurst exponent is related toαby

H=(3?α)

2

(9)

There are a few caveats to be recognized.First,given the limited timescale investigated,it is impossible to determine from these results alone what,if any,long-term e?ects are incorporating the short-term?uctuations.Second,it is an open questions whether the bene?ts of liquidity o?set the increased volatility.Third,this increased volatility due to self-similarity is not necessarily the cause of several high pro?le crashes in stock prices such as that of Proctor&Gamble(PG)on May6, 2010or a subsequent jump(which initiated circuit breakers)of the Washington Post (WPO)on June16,2010.Dramatic events due to traceable causes such as error or a rogue algorithm are not accounted for in the increased volatility though it does not rule out larger events caused by typical trading activities.Finally,this paper does not investigate any induced correlations,or lack thereof,in pricing and returns on short timescales which is another crucial issue.

Traded value,and by extension trading volume,?uctuations are starting to show self-similarity at increasingly shorter timescales.Values which were once only present on the orders of several hours or days are now commonplace in the timescale of seconds or minutes.It is important that the trading algorithms of HFT traders,as well as those who seek to understand,improve,or regulate HFT realize that the overall structure of trading is in?uenced in a measurable manner by HFT and that Gaussian noise models of short term trading volume?uctuations likely are increasingly inapplicable.

Abry,P.,Flandrin,P.,Taqqu,M.S.&Veitch,D.Wavelets for the analysis,estimation,and synthesis of scaling data.In Self-similar network tra?c and performance evaluation eds.Park,K.& Willinger,W.2000(John Wiley&Sons:New York)39-88.

Abry,P.,Flandrin,P.,Taqqu,M.S.&Veitch,D.Self-similarity and long-range dependence through the wavelet lens.In Theory and Applications of Long-Range Dependence eds.Doukan,P.,Taqqu, M.S.,Oppenheim,G.2003,(Birkh¨a user:Boston)527-556.

Addison,P.The Illustrated Wavelet Transform Handbook,2002(CRC Press:Boca Raton). Bardet,J.M.&Kammoun,I.Asymptotic Properties of the Detrended Fluctuation Analysis of Long Range Dependent Processes IEEE Transactions on Information Theory,2008,54,2041-2052. Couillard,M.&Davison,M.A comment on measuring the Hurst exponent of?nancial time series.

Physica A,2005,348404418.

Degryse,H.,van Achter,M.,and Wuyts,G.Shedding Light on Dark Liquidity Pools.TILEC Discussion Paper DP2008-039,2008.

Eisler,Z.,Kert′e sz,J.,Yook,S.H.,&Barab′a si,A.L.,Multiscaling and non-universality in?uctuations of driven complex systems.Europhysics Letters,2005,69,664-670.

Eisler,Z.&Kert′e sz,J.,Liquidity and the multiscaling properties of the volume traded on the stock market.Europhysics Letters,2007,77,28001.

Eisler,Z.&Kert′e sz,J.,The dynamics of traded value revisited.Physica A,2007,382,66-72. Francis,J.C.,Harel,A.and Harpaz,G.Exchange Mergers and Electronic Trading.The Journal of Trading,2009,4:135-43.

Grau-Carles,P.Tests of Long Memory:A Bootstrap https://www.wendangku.net/doc/5f9397766.html,putational Economics,2005,25 103-113.

Harris,L.Trading and Exchanges:Market microstructure for practitioners.2003,(Oxford:New York).

Kaiser,G.A Friendly Guide to Wavelets,1994,(Springer:Berlin).

Lehoczky,J.and Schervish,M.Ch.9High Frequency Trading(lecture notes from Carnegie Mellon University,Pittsburgh,PA)2009.

Leland,W.E.,Taqqu,M.S.,Willinger,W.and Wilson,D.V.On the self-similar nature of Ethernet

tra?c (extended version).IEEE/ACM Transactions on Networking ,1994,2:1,125-151.

Liesenfeld,R.Identifying common long-range dependence in volume and volatility using high

frequency data.SSRN paper ID:326300,2002.

Lo,A.W.,Long-term memory in stock market prices.Econometrica ,1991,59:51279-1313.

Lobato,I.N.and Savin,N.E.Real and Spurious Long-Memory Properties of Stock-Market Data.

Journal of Business &Economic Statistics ,1998,16:3261-268.

Lobato I.N.and Velasco,C.Long memory in stock-market trading volume.Journal of Business &

Economic Statistics ,2000,18:4410-427.

Mandelbrot,B.B.Intermittent turbulence in self-similar cascades:Divergence of high moments and

dimension of the carrier.”Journal of Fluid Mechanics ,1974,62331-358.

Mantegna,R.N.and Stanley,H.E.An Introduction to Econophysics:Correlations and Complexity

in Finance,1999(Cambridge University Press:Cambridge)

Markham,J.W.and Harty,D.J.For Whom the Bell Tolls:The Demise of Exchange Trading Floors

and the Growth of ECNs.Journal of Corporation Law ,2008,33:4866-939.

McAndrews,J.and Stefanadis,C.The Emergence of Electronic Communications Networks in the

U.S.Equity Markets.Current Issues in Economics and Finance (Federal Reserve Bank of New York),2000,6:121-6

Mittal,H.Are You Playing in a Toxic Dark Pool?A Guide to Preventing Information Leakage.The

Journal of Trading ,2008,3:320-33.

Nievergelt,Y.Wavelets Made Easy,1999,(Springer:Berlin)

Palmer,M.Algorithmic Trading:A Primer.The Journal of Trading ,2009,4:330-35.

Percival, D.B.and Walden, A.T.Wavelet Methods for Time Series Analysis,2000,(Cambridge

University Press:New York)

Stoll,H.R.Trading in Stock Markets.The Journal of Economic Perspectives ,2006,20:1153-174Tsay,R.S.Analysis of Financial Time Series.2002.(Wiley:New York).

Appendix A.Appendix:Short introduction to wavelets

Wavelets are a tool to analyze the structure of data series over a variety of scale resolutions.It is often used as an alternative to Fast Fourier Transforms (FFT)in time signals to analyze the frequency responses of signals over various time intervals instead of over the entire signal as in an FFT and is good at revealing sharp spikes or transients FFT would otherwise miss.The reader is encouraged to learn about wavelets in detail using one of the referenced books Percival and Walden (2000);Nievergelt (1999);Kaiser (1994);Addison (2002),however,a simple overview is given here for assistance in understanding the paper’s methodology.

The basic operation of wavelet analysis is the use of a “mother wavelet”ψ0,which has a key feature known as a compact support which means the support is limited to a constrained time period and frequency band.Like Fourier transforms,wavelets can be continuous,or as often used in computer analysis,discrete.There are many mother wavelets,this paper uses the Haar wavelet,but they all share the same basic mathematical properties and ∞?∞ψ0(t )dt =0.One can use wavelets in a discrete wavelet transform (DWT)to analyze the signal,breaking it down into discrete coe?cients,without losing any information about the signal.

The way coe?cients are generated is by stretching the wavelet,where each stretch transformation corresponds to an octave,and then by translating the wavelet over each segment of the signal of length 2j λ0where j is the octave and λ0is the sampling frequency of the signal.So for a signal with 256one second readings,the ?rst octave j =1will produce 128coe?cients (256/21)and the second octave j =2will have 64coe?cients,etc.There will likely be only 7octaves analyzed where j =7has only 2coe?cients.The continuous wavelet transform,of which DWT is a discrete version,is shown below and is essentially a convolution of the signal x (t )against a wavelength where the stretch coe?cient a and the translation coe?cient b determine which part