World+Bank

The World Bank

Working for a World Free of Poverty

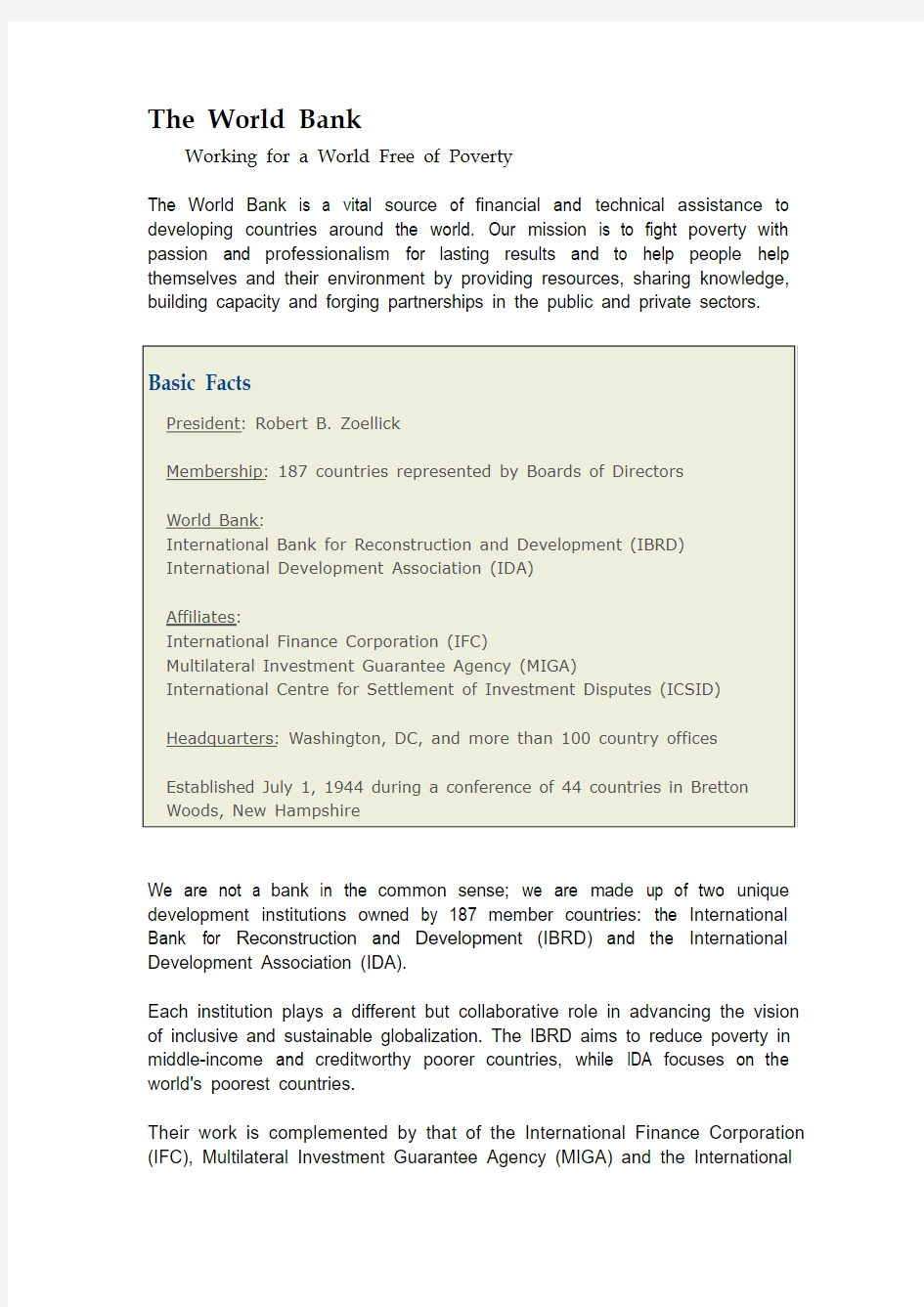

The World Bank is a vital source of financial and technical assistance to developing countries around the world. Our mission is to fight poverty with passion and professionalism for lasting results and to help people help themselves and their environment by providing resources, sharing knowledge, building capacity and forging partnerships in the public and private sectors.

We are not a bank in the common sense; we are made up of two unique development institutions owned by 187 member countries: the International Bank for Reconstruction and Development (IBRD) and the International Development Association (IDA).

Each institution plays a different but collaborative role in advancing the vision of inclusive and sustainable globalization. The IBRD aims to reduce poverty in middle-income and creditworthy poorer countries, while IDA focuses on the world's poorest countries.

Their work is complemented by that of the International Finance Corporation (IFC), Multilateral Investment Guarantee Agency (MIGA) and the International

Centre for the Settlement of Investment Disputes (ICSID).

T ogether, we provide low-interest loans, interest-free credits and grants to developing countries for a wide array of purposes that include investments in education, health, public administration, infrastructure, financial and private sector development, agriculture and environmental and natural resource management.

Challenge

At the World Bank we have made the world's challenge—to reduce global poverty—our challenge.

The Bank focuses on achievement of the Millennium Development Goals that call for the elimination of poverty and sustained development. The goals provide us with targets and yardsticks for measuring results.

Our mission is to help developing countries and their people reach the goals by working with our partners to alleviate poverty. We address global challenges in ways that advance an inclusive and sustainable globalization—that overcome poverty, enhance growth with care for the environment, and create individual opportunity and hope.

Organization

The World Bank is like a cooperative, where its 185 member countries are shareholders. The shareholders are represented by a Board of Governors, who are the ultimate policy makers at the World Bank. Generally, the governors are member countries' ministers of finance or ministers of development. They meet once a year at the Annual Meetings of the Boards of Governors of the World Bank Group and the International Monetary Fund.

Because the governors only meet annually, they delegate specific duties to 24 Executive Directors, who work on-site at the Bank. The five largest shareholders, France, Germany, Japan, the United Kingdom and the United States appoint an executive director, while other member countries are represented by 19 executive directors.

In addition to the International Bank for Reconstruction and Development and the International Development Association, three other institutions are closely associated with the World Bank: the International Finance Corporation (IFC), the Multilateral Investment Guarantee Agency (MIGA), and the International Centre for Settlement of Investment Disputes (ICSID). All five of these institutions together make up the World Bank Group.

Operations

The World Bank's two closely affiliated entities—the International Bank for Reconstruction and Development (IBRD)and the International Development Association (IDA)—provide low or no interest loans and grants to countries that have unfavorable or no access to international credit markets. Unlike other financial institutions, we do not operate for profit. The IBRD is market-based, and we use our high credit rating to pass the low interest we pay for money on to our borrowers—developing countries. We pay for our own operating costs, since we don’t look to outside sources to furnish funds for overhead.

So, where does the money come from to operate the World Bank, and how do we use the funds to carry out our mission?

Fund Generation

IBRD lending to developing countries is primarily financed by selling AAA-rated bonds in the world's financial markets. While IBRD earns a small margin on this lending, the greater proportion of its income comes from lending out its own capital. This capital consists of reserves built up over the years and money paid in from the Bank's 185 member country shareholders. IBRD’s income also pays for World Bank operating expenses and has contributed to

IDA and debt relief.

IDA, the world's largest source of interest-free loans and grant assistance to the poorest countries, is replenished every three years by 40 donor countries. Additional funds are regenerated through repayments of loan principal on 35-to-40-year, no-interest loans, which are then available for re-lending. IDA accounts for nearly 40% of our lending.

Loans

Through the IBRD and IDA, we offer two basic types of loans and credits: investment loans and development policy loans. Investment loans are made to countries for goods, works and services in support of economic and social development projects in a broad range of economic and social sectors. Development policy loans (formerly known as adjustment loans) provide quick-disbursing financing to support countries’ policy and insti tutional reforms. IDA loans are interest free. For information about the IBRD’s financial products, services, lending rates and charges, please visit the World Bank Treasury.

Each borrower’s project proposal is assessed to ensure that the project is economically, financially, socially and environmentally sound. During loan negotiations, the Bank and borrower agree on the development objectives, outputs, performance indicators and implementation plan, as well as a loan disbursement schedule. While we supervise the implementation of each loan and evaluate its results, the borrower implements the project or program according to the agreed terms. As nearly 30% of our staff is based in some 100 country offices worldwide, three-fourths of outstanding loans are managed by country directors located away from the World Bank offices in Washington.

IDA long term loans (credits) are interest free but do carry a small service charge of 0.75 percent on funds paid out. IDA commitment fees range from zero to 0.5 percent on un-disbursed credit balances; for FY06 commitment fees have been set at 0.30 percent. For complete information about IBRD financial products, services, lending rates and charges, please visit the World Bank Treasury. Treasury is at the heart of IBRD's borrowing and lending operations and also performs treasury functions for other members of the World Bank Group.

Grants

Grants are designed to facilitate development projects by encouraging innovation, co-operation between organizations and local stakeholder s’ participation in projects. In recent years, IDA grants—which are either funded directly or managed through partnerships—have been used to:

Relieve the debt burden of heavily indebted poor countries

?Improve sanitation and water supplies

?Support vaccination and immunization programs to reduce the incidence

of communicable diseases like malaria

?Combat the HIV/AIDS pandemic

?Support civil society organizations

?Create initiatives to cut the emission of greenhouse gasses

Analytic and Advisory Services

While we are best known as a financier, another of our roles is to provide analysis, advice and information to our member countries so they can deliver the lasting economic and social improvements their people need. We do this in several ways: through economic research on broad issues such as the environment, poverty, trade and globalization and through country-specific economic and sector work, where we evaluate a country's economic prospects by examining its banking systems and financial markets, as well as trade, infrastructure, poverty and social safety net issues, for example.

We also draw upon the resources of our knowledge bank to educate clients so they can equip themselves to solve their development problems and promote economic growth. By knowledge bank we mean the wealth of contacts, knowledge, information and experience we've acquired over the years, country by country and project by project, in our development work. Our ultimate aim is to encourage the knowledge revolution in developing countries.

These are only some of the ways our analyses, advice and knowledge are made available to our client countries, their government and development professionals, and the public:

?Poverty Assessments

?Public Expenditure Reviews

?Country Economic Memoranda

?Social and Structural Reviews

?Sector Reports

?T opics in Development

Capacity Building

Another core bank function is to increase the capabilities of our own staff, our partners and the people in developing countries—to help them acquire the knowledge and skills they need to provide technical assistance, improve government performance and delivery of services, promote economic growth and sustain poverty reduction programs. Linkages to knowledge-sharing networks such as these have been set up by the Bank to address the vast needs for information and dialogue about development:

?Advisory Servicesand Ask Ushelp desks make information available by

topic via telephone, fax, email and the web. There are more than 25 advisory services at the Bank. Staff members who respond to inquiries add value to the work of our own staff, clients and partners by responding quickly to their knowledge needs. Often, they are the first and possibly the only contact the public at large and the people in developing countries have with the World Bank.

?Global Development Learning Networkis an extensive network of distance

learning centers that uses advanced information and communications technologies to connect people working in development around the world.

?World Bank Institute Global and Regional Programsbring together leading

development practitioners online and face-to-face to exchange experiences and to develop skills.

?B-SPANwebcasting service is an Internet-based broadcasting station that

presents World Bank seminars, workshops and conferences on sustainable development and poverty reduction.