《国际货币与金融经济学》课后习题答案

Chapter 1

https://www.wendangku.net/doc/ff70125.html,ing the following data (billions of dollars) for a given year, calculate the balance on merchandise trade; balance on goods, services, and income; and the current account balance. Indicate whether these balances are deficits or surpluses.

Exports of goods 719 Imports of goods 1,145

Exports of services 279 Imports of services 210

Net unilateral transfers -49 Income receipts 284

Income payments 269 Statistical discrepancy 11

The balance on merchandise trade is the difference between exports of goods, 719 and the imports of goods, 1,145, for a deficit of 426. The balance on goods, services and income is 719 + 279 +284 – 1145 - 210 – 269, for a deficit of 342. Adding unilateral transfers to this gives a current account deficit of 391, [-342 + (-49) = -391]. (Note that income receipts are credits and income payments are debits.)

2.Write out a positive and negative aspect of a nation being a net debtor. Do the same thing for a nation that is a net creditor.

Positive aspects of being a net debtor include the possibility of financing domestic investment that is not possible through domestic savings; thereby allowing for domestic capital stock growth which may allow job, productivity, and income growth. Negative aspects include the fact that foreign savings may be used to finance domestic consumption rather than domestic savings; which will compromise the growth suggested above.

Positive aspects of being a net creditor include the ownership of foreign assets which can represent an income flows to the crediting country. Further, the net creditor position also implies a net exporting position. A negative aspect of being a net creditor includes the fact that foreign investment may substitute for domestic investment.

3.Explain why a nation might desire to receive both portfolio investment and direct investment from abroad.

A nation may desire to receive both portfolio and direct investment due to the type of investment each represents. Portfolio investment is a financial investment while direct investment is dominated by the purchase of actual, real, productive assets. To the extent that a country can benefit by each type of investment, it will desire both types of investment. Further, portfolio investment tends to be short-run in nature, while FDI tends to be long-run in nature.

4.Write out a single equation showing the relationship between the current account and net capital inflows, including changes in official reserves and other government assets, as they relate to investment spending and domestic saving.

Domestic Savings - Domestic Investment = Current Account Balance

Domestic Savings - Domestic Investment = Net Capital Flows

Therefore, Current Account Balance = Net Capital Flows 5.Suppose a nation spends 10 percent of its income on investment and the private sector saves 5 percent. Further, suppose the national government runs a deficit of 1 percent. Explain what the above conditions mean for the nation’s capital ac count and current account. How might the imbalance be corrected?

Using the equations above, private savings of 5 percent of income, government savings of -1 percent, and investment expenditures of 10 percent would results in a current account deficit of 6 percent of income and a capital account surplus (net capital inflows) of 6 percent of income. This could be corrected with a reduction in the government deficit (to a surplus) and/or an increase in private savings.

Chapter 2

1.Suppose the U.S.-dollar-per-currency exchange rate of the euro was 1.2201 on Thursday and 1.2168 on Friday. Did the euro appreciate or depreciate relative to the U.S. dollar? How much was the appreciation/depreciation (in percentage change terms)?

The euro depreciated relative to the dollar. The rate of depreciation (in absolute value) was [(1.2168 – 1.2201)/1.2201]100 = 0.27 percent.

3.Suppose in New York the euro and British pound trade at the following exchange rates: 1.234$/€, and $/£=1.702. In London, the euro equivalent rate of the pound is 1.425€/£. Is there an arbitrage opportunity? Why or why not? Calculate the profit to be made on $1,000,000.

The cross rate is 1.702/1.234 = 1.379 (€/£). The arbitrageur would purchase £587,544 ($1,000,000/1.702) with the $1 million in the New York market. Next they would use the £587,544 in London to purch ase €837,250 (£587,544*1.425). Finally, they would sell the €837,250 in the NY market for $1,033,167 (€837,250*1.234). The pr ofit is #33,167.

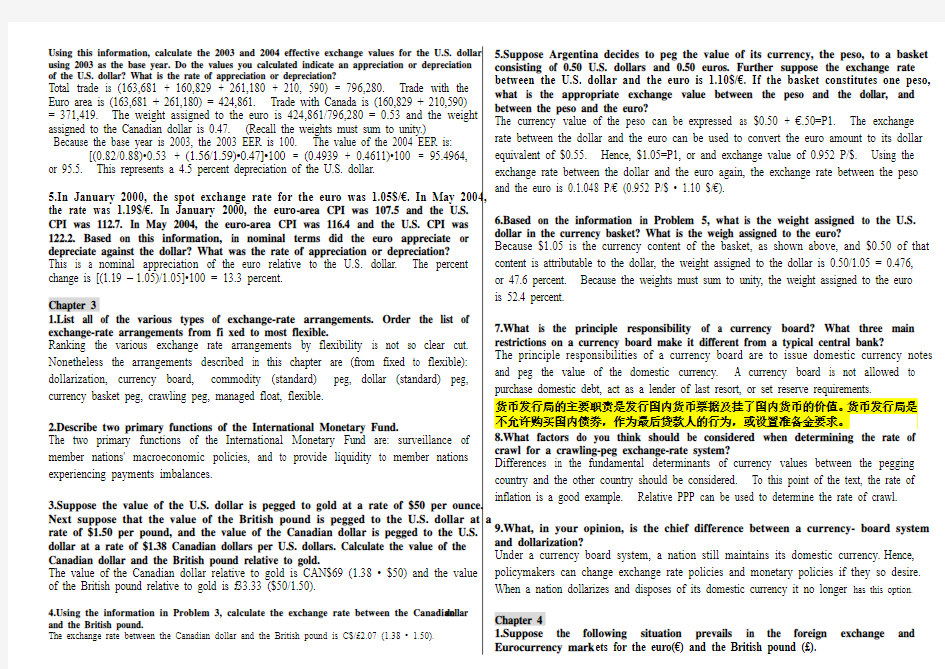

Using this information, calculate the 2003 and 2004 effective exchange values for the U.S. dollar using 2003 as the base year. Do the values you calculated indicate an appreciation or depreciation of the U.S. dollar? What is the rate of appreciation or depreciation?

Total trade is (163,681 + 160,829 + 261,180 + 210, 590) = 796,280. Trade with the Euro area is (163,681 + 261,180) = 424,861. Trade with Canada is (160,829 + 210,590) = 371,419. The weight assigned to the euro is 424,861/796,280 = 0.53 and the weight assigned to the Canadian dollar is 0.47. (Recall the weights must sum to unity.) Because the base year is 2003, the 2003 EER is 100. The value of the 2004 EER is: [(0.82/0.88)?0.53 + (1.56/1.59)?0.47]?100 = (0.4939 + 0.4611)?100 = 95.4964, or 95.5. This represents a 4.5 percent depreciation of the U.S. dollar.

5.In January 2000, the spot exchange rate for the euro was 1.05$/€. In May 2004, the rate was 1.19$/€. In January 2000, the euro-area CPI was 107.5 and the U.S. CPI was 112.7. In May 2004, the euro-area CPI was 11

6.4 and the U.S. CPI was 122.2. Based on this information, in nominal terms did the euro appreciate or depreciate against the dollar? What was the rate of appreciation or depreciation? This is a nominal appreciation of the euro relative to the U.S. dollar. The percent change is [(1.19 –1.05)/1.05]?100 = 13.3 percent.

Chapter 3

1.List all of the various types of exchange-rate arrangements. Order the list of exchange-rate arrangements from fi xed to most flexible.

Ranking the various exchange rate arrangements by flexibility is not so clear cut. Nonetheless the arrangements described in this chapter are (from fixed to flexible): dollarization, currency board, commodity (standard) peg, dollar (standard) peg, currency basket peg, crawling peg, managed float, flexible.

2.Describe two primary functions of the International Monetary Fund.

The two primary functions of the International Monetary Fund are: surveillance of member nations' macroeconomic policies, and to provide liquidity to member nations experiencing payments imbalances.

3.Suppose the value of the U.S. dollar is pegged to gold at a rate of $50 per ounce. Next suppose that the value of the British pound is pegged to the U.S. dollar at a rate of $1.50 per pound, and the value of the Canadian dollar is pegged to the U.S. dollar at a rate of $1.38 Canadian dollars per U.S. dollars. Calculate the value of the Canadian dollar and the British pound relative to gold.

The value of the Canadian dollar relative to gold is CAN$69 (1.38 ? $50) and the value of the British pound relative to gold is £33.33 ($50/1.50).

https://www.wendangku.net/doc/ff70125.html,ing the information in Problem 3, calculate the exchange rate between the Canadian dollar and the British pound.

The exchange rate between the Canadian dollar and the British pound is C$/£2.07 (1.38 ? 1.50).5.Suppose Argentina decides to peg the value of its currency, the peso, to a basket consisting of 0.50 U.S. dollars and 0.50 euros. Further suppose the exchange rate between the U.S. dollar and the euro is 1.10$/€. If the basket constitutes one peso, what is the appropriate exchange value between the peso and the dollar, and between the peso and the euro?

The currency value of the peso can be expressed as $0.50 + €.50=P1. The exchange rate between the dollar and the euro can be used to convert the euro amount to its dollar equivalent of $0.55. Hence, $1.05=P1, or and exchange value of 0.952 P/$. Using the exchange rate between the dollar and the euro again, the exchange rate between the peso and the euro is 0.1.048 P/€ (0.952 P/$ ? 1.10 $/€).

6.Based on the information in Problem 5, what is the weight assigned to the U.S. dollar in the currency basket? What is the weigh assigned to the euro?

Because $1.05 is the currency content of the basket, as shown above, and $0.50 of that content is attributable to the dollar, the weight assigned to the dollar is 0.50/1.05 = 0.476, or 47.6 percent. Because the weights must sum to unity, the weight assigned to the euro is 52.4 percent.

7.What is the principle responsibility of a currency board? What three main restrictions on a currency board make it different from a typical central bank?

The principle responsibilities of a currency board are to issue domestic currency notes and peg the value of the domestic currency. A currency board is not allowed to purchase domestic debt, act as a lender of last resort, or set reserve requirements.

货币发行局的主要职责是发行国内货币票据及挂了国内货币的价值。货币发行局是不允许购买国内债券,作为最后贷款人的行为,或设置准备金要求。

8.What factors do you think should be considered when determining the rate of crawl for a crawling-peg exchange-rate system?

Differences in the fundamental determinants of currency values between the pegging country and the other country should be considered. To this point of the text, the rate of inflation is a good example. Relative PPP can be used to determine the rate of crawl.

9.What, in your opinion, is the chief difference between a currency- board system and dollarization?

Under a currency board system, a nation still maintains its domestic currency. Hence, policymakers can change exchange rate policies and monetary policies if they so desire. When a nation dollarizes and disposes of its domestic currency it no longer has this option.

Chapter 4

1.Suppose the following situation prevails in the foreign exchange and Eurocurrency mark ets for the euro(€) and the British pound (£).

One-year Eurocurrency rates: Euro 3.125% British pound 4.250% Exchange rates: Spot 1.5245€/£One-year forward 1.4575€/£Explain how an individual would profit from financial arbitrage in this situation. Calculate the percentage return the individual would earn from undertaking arbitrage activity. Keep all of your calculations to four decimal points for accuracy. Because (1.03125) > (1.04250)(1.4575/1.5245) = 0.9967, an arbitrage opportunity exists in this example if one were to borrow the pound and lend the euro. Suppose you were to borrow one pound, the steps are then:

a. Borrow £1, convert to €1.5245 on the spot market.

b. Lend euros, yielding €1.5245?(1.03125) = €1.5721.

c. See euros forward, yielding €1.5721/1.4575 = £1.0787.

d. Repay the pound loan at £1?(1.04250) = £1.04250.

e. The profit is £0.0362, or 3.62 percent.

2.Suppose the spot exchange rate between the dollar and the euro is 1.08$/€. The dollar can be borrowed for one year at 1.75 percent and the euro can be lent for one year 3.25 percent. What should be the forward premium or discount? What should be the one-year forward rate?

Given this information, we can calculate the forward premium/discount with the UIP condition: (F - S)/S = R - R*

The interest differential is 1.75% - 3.25% = 1.5%. This is the expected forward premium on the euro. Hence, (F – 1.08)/1.08 = 0.015 implies that F = 1.0962.

3.Suppose the short-term U.S. interest rate is 1.24 percent and the Canadian rate is 2.15 percent, while forecasted inflation is 2.1 percent and 2.6 percent, respectively. Calculate the real interest rate for each country. Does real interest parity hold?

The U.S. real rate is 1.24% – 2.1% = -0.86% and the Canadian real rate is 2.15% – 2.6% = -0.45%. Ignoring transaction costs, because the real interest rates are not equal, real interest parity does not hold.

4.Characterize each of the following financial instruments as either a global equity, global bond, Eurocurrency, Euronote, Eurobond, or Eurocommercial paper.

a. A Brazilian firm offers a ten-year debt instrument for sale to international savers.

b. The government of Mexico offers a three-year debt instrument, denominated in the U.S. dollar, for sale on the London market.

c. Citibank of New York borrows a pound-denominated deposit from Royal Bank of Canada.

d. A Brazilian firm offers shares of its stock for sale to international savers. International financial instruments:

a. Global Bond: long term instruments issued in the domestic currency.

b. Eurobond: term is longer than one year and is issued in a foreign currency.

c. Eurocurrency: keyword is that it is a deposit.

d. Global equity: keyword is that it is a shar

e.

Chapter 5 1. The formula for the price of a perpetual, nonmaturing bond with an annual coupon return of C is C/R. Note that the discounted present value of C dollars received each year forever is equal to the infinite sum,

PB=C/(1+R)+ C/(1+R)2+ C/(1+R)3 +C/(1+R)4+…

The amount PB should be the price that the bearer of the consol would be willing to pay to hold this instrument. And so PB

Should equal C/R. Prove that this is true. [Hint: Try multiplying the equation above by the factor 1/(1+R). Then subtract the resulting equation from the equation above. Then solve for PB.]

A:Given that: PB = C/(1+R) + C/(1+R)2 + C/(1+R)3 + C/(1+R)4 + ...;

multiply each side by (1+R): PB (1+R) = C + C/(1+R) + C/(1+R)2 +...;

and subtract PB from each side: PB (1+R) - PB = [C + C/(1+R) + C/(1+R)2 +...] - [C/(1+R) + C/(1+R)2 +...];

Simplifying: PB * R = C. Therefore, PB = C/R.

2. Suppose that traders currently anticipate that during the next year the dollar will depreciate by

3.5 percent relative to the euro. At present, the market interest rate on a U.S. Treasury security is 5 percent, and the market interest rate on a German government bond with the same risk characteristics and the same maturity is 3 percent. Is there an excess return available from holding the German government bond? If so, what is the amount of the excess return?

A:Yes, the excess return on the German government bond 3.5%–(5%–3 %) = 1.5% 3. In what ways does a currency futures contract differ from a forward currency contract?

A:In contrast to forward currency contracts, currency futures require delivery of standard quantities of currencies. In addition, holders of currency futures experience profits of losses on the contracts during the entire period before the contracts expire, whereas profits or losses occur only at the expiration date of a forward currency contract. 与此相反的远期外汇合约,外汇期货需要提供的标准品数量的货币。此外,持有的外汇期货合同到期之前的整个期间遇到的合同而遭受损失的利润,而利润或亏损只发生在远期外汇合约的到期日。

4. Why is a currency futures option a “derivative of a derivative”? Explain briefly. A:A currency future already is a derivative, because its value varies with the exchange rate. The value of a currency futures option, in turn, depends on the underlying value of a currency futures contract, so its value is derived from the futures derivative. In this way, a currency futures option is a "derivative of a derivative."

5. Using the following table, consider an American-style call option on the euro. The current euro spot exchange rate is $0.9657, and each option contract is for €62,500.

Calls Puts

Vol. Last Vol. Last

960 Jun … … 5 0.0161

980 Jun 14 0.0188 … …

1000 Jun 1 0.0117 … …

1020 Jun 1 0.0600 … 0.0100

a. Is the 980 call option currently in the money, at the money, or out of the money?

b.Suppose that your corporate economist believes the euro may appreciate against the dollar to an exchange value as high as $1.02 or depreciate to an exchange value as low as $0.96.She therefore purchases eight call contracts to partially hedge an underlying short exposure of $750,000. Draw a diagram illustrating the potential loss or gain on eight call contracts.

c.Indicate the amount of loss or profit at $0.96, $1.02, and the current spot rate. (Keep all calculations to two decimal places.)

d.Indicate the break-even rat

e.

e.Add to your diagram a line indicating the gain and loss on the underlying exposure as the spot deviates form the current level. Indicate the gain or loss at $0.96 and $1.02.

A:a. The call option is currently out of the money.

b. (0.0188)(62,500) = $1,175

($1,175)(8 contracts) = $9,400

c. At S = $0.96/ € the option is not exercised and the firm is out $9,400

At S = $1.02/ € the option is exercised. The firm earns $10,600

A t S = $0.9657/€, the firm does not exercise the option and is out $9,400

d. Break even: $0.9988/€

e. See Diagram given in part (b).

Chapter 6

1. Suppose that a Japanese bank has total assets of ¥1,000 million. Of these assets, 80 percent are loans to businesses, and the remainder are holdings of cash assets and government securities. The bank engages in derivatives trading that Japanese regulators assign a credit equivalence exposure value of ¥400 million. The bank’s equity capital amounts to ¥100 million, and the bank has no subordinated debt. Does this bank meet current capital requirements? A:he bank's capital-asset ratio is equal to it equity of 100 million yen divided by its total assets of 1,000 million yen, which equals 0.10, or 10 percent. Hence, the bank definitely meets the 4 percent capital-asset ratio requirement. Because cash assets and government securities receive a zero risk weight, this bank has 800 million yen in loans that it must count among risk-adjusted assets. Together with the assigned exposure of 400 million yen from derivatives trading, this yields a total amount of risk-adjusted assets equal to 1,200 million yen. Thus, the bank's risk-adjusted core capital ration is equal to 100 million yen divided by 1,200 million yen, which is equal to just over 0.083, or 8.3 percent. Thus, the bank's risk-adjusted core capital ratio also meets the 8 percent regulatory requirement.

他银行的资本资产比率至100亿日元除以它的总资产为1000万日元,相等于0.10,或10%的股权,是平等的。因此,银行肯定达到4%的资本资产比率要求。因为现金资产和政府债券收到一个零风险权重,这家银行的贷款,它必须计算风险调整后的资产中,有8亿日元。再加上400万日元衍生品交易指定的曝光,这会产生等于1200万日元的风险调整后的资产总额为。因此,银行的风险调整后的核心资本比为等于100亿日元除以1200万日元,这是刚刚超过0.083或8.3%。因此,银行的风险调整后的核心资本充足率也达到8%的监管要求。

2.In what ways do the current functions and objectives of the International Monetary Fund and the World Bank overlap? In what ways do they have different functions and pursue different goals?

The main overlap in the institutions’ functions is that both make long-term loans intended to promote growth of developing and emerging nations. The World Bank, however, concentrates solely on this task, whereas the International Monetary Fund focuses much of its attention lending to promote short- and intermediate-term stabilization.

Chapter 7

1. Explain the difference between direct and indirect financing. Next explain why a nation might desire a strong and stable system of financial intermediaries and a robust bond market.

A:The difference between direct and indirect financing has to do with whether the borrower and lender seek each other out or whether an intermediary matches borrowers and lenders. Direct financing requires no intermediary to match savers and borrowers. An economy will benefit from having both direct and indirect financing because both are appropriate ways to save and invest under different circumstances. As discussed in the text, financial intermediaries absorb a fraction of each saver's dollar that is borrowed. Thus, the intermediary takes some of the funds that otherwise would have gone to a borrower. However, the financial intermediary provides an important service by reducing information asymmetries, allowing savers to pool risk, and matching risk and return.

Therefore, when an individual cannot research these issues on his/her own, the intermediary is necessary to help the financial markets operate. However, a strong bond market, in which borrowers and savers can directly interact, allows for informed parties to save the funds that otherwise would go to an intermediary. This, in turn, uses the savings more efficiently.

直接融资和间接融资之间的差异做的借方和贷方是否寻求相互的,还是中介比赛借款人和贷款人。直接融资需要,以配合储蓄者和借款人的中介。因为两者都是适当的储蓄和投资的方式在不同的情况下,一个经济体将受益于具有直接融资和间接融资的。文中所讨论的,金融中介机构吸收一小部分,每个保护的美元是借来的。因此,的中介需要一些,否则会已经向借款人的资金。然而,金融中介机构提供的一项重要服务,减少信息不对称,让储户池风险,匹配风险和回报。

因此,当一个人无法考证这些问题对他/她自己的,中介机构是必要的,有助于金融市场的运作。然而,一个强大的债券市场,在借款人与投资者直接互动,让知情人士节省的资金,否则将去中介。,反过来,这更有效地使用的储蓄。

2.List three benefits of portfolio capital and three benefits of foreign direct investment. Give one negative aspect of each. Explain why it is undesirable to rely on portfolio capital only. Explain why it is undesirable to rely on FDI only. Portfolio flows are relatively short term in nature (have a shorter term to maturity), involve lower borrowing costs, and can generate near-term income. They also do not require a firm to give up control to a foreign investor. Consequently, they may help to improve capital allocation within an economy and help the economy's financial sector develop. These are all potential benefits of portfolio investments. By the same token, however, they are also relatively easy to reverse in direction, which is a potential disadvantage of portfolio investment.

On the other hand, foreign direct investment (FDI) involve some degree of ownership and control of a foreign firm, are typically long term in nature, and help provide a stabilizing influence on a nation's economy. As such, FDI is typically more difficult to arrange.

It is not advantageous to rely on either type of investment exclusively, in so far as each type accomplishes different goals for an economy. Both near-and long-term capital are important for an economy's growth.

证券投资的流动是相对短期性质(有一个较短的到期日),包括更低的借贷成本,并能产生短期的收入。他们也并不需要放弃控制权的公司向外国投资者。因此,它们可能有助于提高资金分配一个经济体系内,并帮助经济体的金融部门发展。这些都是潜在的好处的投资组合。同样的道理,然而,他们也比较容易扭转的方向,这是一个潜在的缺点证券投资。

另一方面,外国直接投资(FDI)涉及一定程度的所有权和控制权的外国公司,是典型的长期性质,并提供对一个国家的经济稳定的影响。因此,外国直接投资通常是更难安排。

这是不利于依靠专用两种类型的投资,至今各类型实现不同的目标的经济。两个近期和长期的资本是非常重要的一个经济体的增长。

3. Suppose you are a policymaker in an emerging economy. Explain what types of capital flow you would try to encourage. What policy actions might you take to encourage these types of flows?

A:Policymakers should undertake actions that attract both portfolio capital flows and FDI flows. Actions that improve transparency in both the private a public sector reduces information asymmetries and their associate problems thereby making portfolio flows more stable, in other words, reducing the risk of massive capital outflows. Policymakers may also undertake actions that promote education, improve the tax structure and tax collection, and improve the countries infrastructure. These actions may, in turn, attract FDI.

政策制定者应该采取行动,吸引投资资本流动和外国直接投资。提高透明度的动作,在私营的公共部门减少信息不对称及其联营问题,从而使投资组合流动更加稳定,换句话说,减少大规模资本外流的风险。政策制定者也可以采取行动,促进教育,提高税收结构和税收征管,改善国家的基础设施。反过来,这些行动可能会吸引外国直接投资。

4. Some observers have responded to harsh criticisms of World Bank policies by arguing that the World B ank’s members have saddled it with conflicting goals. Do you agree that the World Bank confronts conflicting objectives? If not, why not? If so, which of the allegedly conflicting goals do you think should take precedence? A:The World Bank was initially established to help countries rebuild after WWII and in the 1960s expanded to also make long term loans to developing nations in order to help reduce poverty and improve living standards. Recently, some of the World Bank's activities have begun to overlap the IMF's activities to finance long-term structural adjustments and provide refinancing for some heavily indebted countries. Critics may argue that the tasks that are duplicated by the IMF and the World Bank create conflicting goals for the World Bank. Thus, the two organizations may each benefit by focusing on different aims. For instance, the IMF may return to financing shorter-term objectives and leave the World Bank to worry about longer-term projects.

Another conflicting line of reasoning involves donors' expectation that the World Bank maintain a revenue stream form its projects. This can be argues as unrealistic, however, in that the poorest countries are less likely to yield a payoff for the needed projects; and these are precisely the countries that the World Bank is designed and intended to help. On the other hand, the less risky projects, which could provide a positive revenue stream are likely to attract private capital.

世界银行最初建立是为了帮助国家重建二战之后,在20世纪60年代扩大,也使发展中国家的长期贷款,以帮助减少贫困和改善人民生活水平。最近,世界银行的一些活动已经开始重叠IMF的活动,以资助长期的结构调整,并提供一些负债累累的国家的再融资。批评人士可能会认为,重复的任务由IMF和世界银行世界银行建立相互矛盾的目标。因此,这两个组织可以分别针对不同的目标。例如,IMF融资的短期目标,离开世界银行担心长期的项目。

另一种冲突的推理,世界银行维持收入流形成的项目包括捐助者的期望。这可以被认为是不切实际的,但是,最贫穷的国家是不太可能产生所需要的项目的回报;而这些恰恰是国家,世界银行的设计,旨在帮助。另一方面,风险较低的项目,它可以提供一个积极的收入流可能会吸引私人资本。

5. Construct a table with three columns that lists each of the views on the causes of international financial crises in the left-hand column. In the second column of the table, list at least one possible financial crisis indicator corresponding to each view that might be tracked in an IMF early warning system for predicting financial crises. In the third column, propose how to evaluate whether each potential indicator you have proposed actually helps predict a crisis. Does this exercise help explain why economists have a hard time constructing reliable early warning systems?

A:The first cause of a crisis could be an imbalance in the economy. In other words, an incongruity in economic fundamentals could cause a crisis. Possible indicators include theoretical divergences between various economic variables such as the exchange rate and interest rates, income, and money supply. In terms of evaluation, if fundamental economic variables seem to be out of line, there may be an impending crisis.

A second cause is that of self-fulfilling expectations and contagion effects. In this case, mere expectations of a potential inability to maintain a specified exchange rate or a slight incongruity between economic conditions and the market exchange rate may cause a cascade of speculation that leads to a crisis. Since this is based on perception, it is difficult to find an indicator. One possible indicator would be trading volumes of currency for countries that may be at risk from the viewpoint of economic fundamentals. If trading volumes grew quickly, a crisis may be on the horizon.

Finally, the structural moral hazard problem may indicate a crisis. In this case, a credit rating bureau, such as Moody's may provide the data needed to indicate a potential crisis. The quality of the credit rating would be relatively easily interpreted to indicate a potential crisis.

经济危机的第一个原因可能是不平衡的。换句话说,在经济基本面的不协调可能导致危机。可能的指标包括各种经济变量,如汇率,利率,收入和货币供应量之间的理论分歧。在评价方面,如果基本经济变量似乎是脱节的,有可能是即将发生的危机。

第二个原因是,自我实现的期望和传染效应。在这种情况下,仅仅是一个潜在的无法维持指定的经济条件和市场汇率之间的汇率或轻微的不协调的期望可能会导致级联的猜测,导致危机。由于这是基于对知觉的,它是很难找到一个指标。一个可能的指标将交易量的货币,从经济基本面的角度来看,可能是在风险的国家。如果交易量迅速增长,危机可能会在地平线上。

最后,结构性的道德风险问题,可能表明了危机。在这种情况下,如穆迪的信用评级局,可以提供所需要的数据来表示一个潜在的危机。的信用评级的质量会相对容易地解释为表示一个潜在的危机。

Chapter 8

1. Slovakia is an international supplier of hockey pucks. Suppose that Slovakia prices and sells its hockey pucks on the international market in the U.S. dollar. What happens to Slovakia’s exports when the currency of a major consumer of hockey pucks, Canada, depreciates 5 percent against the U.S. dollar? Suppose Slovakia hockey puck producers desire to maintain the market share they have in Canada. Thus, they are willing to adjust their price for hockey pucks so that the quantity of hockey pucks demanded remains constant. How much would Slovakia have to reduce the price of hockey pucks to maintain its current level of exports to Canada?

A:If the Canadian dollar depreciates relative to the U.S. dollar, then the quantity of hockey pucks demanded declines. Hence, Slovakian manufacturers would have to absorb all of the exchange rate change in their profit margins and the price of hockey pucks would have to decline by 5 percent for the quantity demanded to remain unchanged.

2. Suppose that real consumption expenditures in a nation are $10,000, real investment expenditures are $8,000, real government expenditures are $5,000, real expenditures on imports are $1,000, and real exports are $500. (a) What are the nation’s levels of real income and absorption? (b) What is its trade balance?

A:a. real income, y= c + i + g + x = $23,500, absorption,y= c + i + g + im = $24,000.

b. Net exports, x - im, equals -$500. Therefore, there is a trade deficit of $500.

3. Explain how a “Buy American” advertising campaign is similar to an expenditure switching policy. What is the potential impact the campaign might have on the balance of payments in the context of the absorption approach?

A:The advertising campaign would induce consumers to increase expenditures on domestic output and decrease expenditures on foreign output. Domestic absorption will rise and, if expenditures on imports decrease, the trade balance improves.

4. Suppose the U.S economy expands at a faster pace than that of its trading partners. Using the absorption approach, explain why the U.S. dollar might depreciate relative to the currencies of its trading partners. Explain why the U.S. dollar might appreciate relative to the currencies of its trading partners.

A:As the U.S. economy expands, we would expect real income and real absorption to increase. On the one hand, if real income increases more than real absorption, net exports will rise. This would lead to an appreciation of the U.S. dollar. If, on the

other hand, real absorption rises faster than real income, net exports fall. This would lead to a depreciation of the U.S. dollar.

Chapter 9

1. Write out an equation representing the monetary approach to balance of payments and exchange rate determination. Suppose that domestic credit equals $1000 million, foreign exchange reserves equal $80 million, the money multiplier is 2, the fraction of nominal income that individuals desire to hold in money balances is 20 percent, the foreign price level 1.2, and the spot exchange value of the domestic currency is

2. Using its information, what is:

a. the money stock In the domestic economy?

b. the level of real income of the domestic economy?

Using the formula provided on page 222, m(DC + FER) = kSP*y.

a. The money stock is 2($1,000 + $80) = $2,160 million.

b. The level of real income is: [2($1,000 + $80)]/[(0.20)(1.2)(2)] = $4,500 million.

2. Write out the equation representing the monetary approach to balance of payments and exchange rate determination. Suppose the domestic monetary authorities increase domestic credit by $10 million through an open-market purchase of securities.

a. Under a fixed exchange-rate regime, what is the effect of this open-market transaction on the nation’s balance of payments?

b. Under flexible exchange rates, all other things constant, what is the new exchange value of the domestic currency? Is this an appreciation or depreciation? An open market purchase of securities in the amount of $10 million:

a.A fixed exchange rate regime requires a decrease in foreign reserves in an equal amount. Hence, this action results in a balance of payments deficit in the amount of $10 million.

b.A flexible exchange rate regime results in a new spot exchange rate of 2.019, which is a depreciation of the domestic currency. This problem is solved by using the value for real income derived in 5 b above: [(2($1,010 + 80)]/[(0.20)(1.2)($4,500)] = 2.019.

3. Write out the wealth identity. Using this identity, explain the impact of a central bank open-market sale of bonds on the exchange value of the domestic currency. Now suppose that the exchange rate is pegged. Using the wealth identity, explain the impact of the open-market operation on the domestic nation’s balance of payments. The wealth identity is given on page 229 as W≡ M + B+ SB*. An open market sale of securities would reduce bank reserves, increasing the domestic interest rate. Individuals would shift from foreign bonds to domestic bonds, leading to an appreciation of the domestic currency. Under a fixed exchange rate, the open market sale would result in an improvement of the domestic nation’s balance of payments.一个开放的市场销售的证券将降低银行存款准备金,提高国内利率。个人转变,从外国债券国内债券,从而导致本国货币的升值。在固定汇率,公开市场出售可能导致在国内国家的国际收支的改善。

4. Write out a wealth identity for both the domestic economy and the foreign economy. Using this identity, explain the impact of an open-market sale of bonds by the central bank of the foreign economy on the exchange value between the domestic and foreign currencies. The wealth identity is given on page 315 as W≡M + B SB*. From the foreign nation it is W ≡M* + B* + (1/S)B. An open market sale of securities by the foreign central bank would reduce foreign bank reserves, increasing the foreign interest rate relative to the domestic interest rate. Individuals would shift from domestic bonds to foreign bonds, leading to an depreciation of the domestic currency.

外国央行公开市场出售证券将减少对外国银行准备金,增加了外国利率相对于国内利率。个人转变,从国内债券,外国债券,导致国内货币贬值。

Chapter 14

1. The central bank in a small open economy with perfect capital mobility and a floating exchange rate reduces the nation’s money stock. Explain how the exchange rate must adjust in the long run when relative purchasing power is assumed to hold. A:A reduction in the money stock causes the aggregate demand schedule to shift leftward along the long-run aggregate supply curve, and the price level decreases in the long run. According to relative purchasing power, which is assumed to hold in the long run, the ultimate effect is a decrease in the exchange rate, or a domestic currency appreciation.

货币存量的减少导致总需求计划转向长期总供给曲线向左沿,从长远来看,价格水平下降。根据相对购买力,这是假设持有从长远来看,最终的效果是减少了汇率,国内货币升值。

2. A nation’s economy becomes more open, and as or consequence, aggregate real output becomes less responsive to short-run reasoning provided in the price level. Discuss factors that might help explain why this has occurred.

A:In a nation with perfectly competitive product markets, this might occur because workers respond to increased openness by incorporating more indexation of wages into their contractual agreements with employers or because greater openness by countries that import a relatively large amount of inputs makes product prices adjust more rapidly to changes in input prices.

在一个国家完全竞争的产品市场,这可能会发生,因为工人到他们与雇主的合同协议,或者因为更加开放的国家进口数额较大的投入,使产品的价格调整更迅速地将更多的工资指数化的应对更加开放投入价格的变化。

3. Discuss two possible reasons why greater openness of a nation’s economy might be associated with lower inflation.

A: If increased openness reduces the pricing power available to firms in a country with imperfectly competitive product markets, their inability to raise their prices as much as before when the quantity of output demanded increases might reduce inflation. Alternatively, if greater openness results in a steeper aggregate supply schedule in a nation with perfectly competitive product markets, then there is less incentive for the central bank in that nation to try to generate short-term increases in output via inflationary monetary policies, which reduces inflation.

如果增加的开放性降低了定价能力,公司在不完全竞争的产品市场,提高他们的价格他们无法象以前一样的国家的数量输出要求的增加可能会降低通胀。另外,如果在一个陡峭的总供给曲线在一个国家完全竞争的产品市场更加开放的结果,然后有激励该国央行在试图通过通货膨胀的货币政策,从而降低产生短期的产量增加了通货膨胀。

Chapter 15

1. A domestic government enacts a significant cut in taxes intended to spur its domestic industries. In addition, however, the tax cut gives foreign-owned firms an incentive to relocate their offices and production facilities within domestic borders. The tax cut also has been carefully crafted to avoid spurring increased imports by domestic citizens. Would these effects of this domestic policy action be an example of a positive or negative international policy externality? Explain.

A:This is an example of a negative policy externality because the domestic tax cut tends to stimulate domestic real-income growth at the expense of lower real-income growth in the other country. As a result, the domestic tax cut has a beggar-thy-neighbor effect on the other nation.

2. Workers who speak a common language and share a common culture are completely mobile within a region that encompasses three small economies that engage in large volumes of international trade and have floating exchange rates. Residents in each country must incur sizable costs each time they convert their home currency into a foreign currency, and they face significant foreign exchange risks. Is this region a potential candidate for monetary union? Justify your answer. A:According to the optimal-currency-area theory, these three economies are good candidates for a single currency. If events were to affect the sub-regions differently, causing payment imbalances among the sub-regions, then the residents, who share a common culture and language and are highly mobile, could adjust by moving as desired among the regions. Hence, exchange-rate adjustments are not necessary to cushion the sub-regions in the face of such imbalances. Adopting a single currency would permit them to avoid the sizable currency-conversion costs that they currently face.

这三个经济体的最优货币区理论,单一货币的很好的候选人。如果事件以不同的方式影响次区域,次区域之间的不平衡导致支付,那么居民,他们都有一个共同的文化和语言,流动性大,各地区之间移动所需的调整。因此,汇率调整是没有必要的,以减轻次区域在面对这种不平衡现象。采用单一货币将允许它们避免了相当大的货币,他们目前面临的转换成本。

3. Suppose that a country’s re sidents speak a language that most others around the world do not know. There also are legal and natural impediments to movements of factors of production across the nation’s borders. The nation’s central bank maintains a fixed exchange rate. Recently, there has been a worldwide fall in the demand for the nation’s primary products. Could this nation gain from letting its exchange rate float? Explain your reasoning.

A:The language barrier combines with the other legal and natural barriers for factor movement and serves as an impediment to labor mobility. In this case, the country could benefit from adopting a flexible exchange rate. If a flexible exchange rate were in effect, the increased trade deficit would lead to a natural depreciation of the nation's currency. This would help to stabilize aggregate demand (i.e., reduce its fall) by making imports more expensive and exports less expensive. Maintaining a fixed exchange rate eliminates this stabilizing channel.

语言障碍,与其他法人和自然人的障碍因素运动相结合,并作为劳动力流动的障碍。在这种情况下,国家可以采取灵活的汇率中受益。如果一个灵活的汇率影响,增加的贸易赤字将导致该国货币的自然贬值。通过使进口更加昂贵,出口更便宜,这将有助于稳定总需求(即降低其秋季)。维持固定汇率,消除了这种稳定的通道。4. Discuss the potential advantages of coordinating national monetary policies. Of these, which do you think is most important? Why?

A:Potential benefits of national coordination of monetary policies include the internalization of policy externalities, the optimization of the outcome of the limited set of policy instruments, the benefit of external commitments when faced with internal pressures to follow short-term goals at the expense of long term stability. Answers will vary as to which one is considered the most important.

5. Discuss the likely disadvantages of international monetary-policy coordination. Which do you believe to be the greatest disadvantage? Take a stand, and justify your position.

A:Potential disadvantages of monetary policy coordination include the sovereignty an individual country sacrifices, the potential of one country to "cheat" on another by deviating from the agreed upon coordination strategy, the potential of poor policy making by a member country, and the added potential of inflation bias when credibility levels are low within individual nations. Answers will vary regarding which is the greatest sacrifice.

各大学教材课后习题答案网址

各大学教材课后习题答案网址 《线性代数》(同济第四版)课后习题答案(完整版) 高等数学(同济第五版)课后答案(PDF格式,共527页) 中国近现代史纲要课后题答案 曼昆《经济学原理》课后习题解答 21世纪大学英语读写教程(第三册)参考答案 谢希仁《计算机网络教程》(第五版)习题参考答案(共48页) 《概率论与数理统计》习题答案 http:// 《模拟电子技术基础》详细习题答案(童诗白,华成英版,高教版) 《机械设计》课后习题答案(高教版,第八版,西北工业大学) 《大学物理》完整习题答案 .com/viewthread.php?tid=217&fromuid=164951 《管理学》课后答案(周三多) 机械设计基础(第五版)习题答案[杨可桢等主编] 程守洙、江之永主编《普通物理学》(第五版)详细解答及辅导 .php?tid=3&fromuid=164951 新视野大学英语课本详解(四册全) 21世纪大学英语读写教程(第四册)课后答案 新视野大学英语读写教程3册的课后习题答案 1

新视野大学英语第四册答案(第二版) 《中国近现代史》选择题全集(共含250道题目和答案) 《电工学》课后习题答案(第六版,上册,秦曾煌主编) 完整的英文原版曼昆宏观、微观经济学答案 《数字电子技术基础》习题答案(阎石,第五版) 《电路》习题答案上(邱关源,第五版) 《电工学》习题答案(第六版,秦曾煌) https://www.wendangku.net/doc/ff70125.html,/viewthread.php?tid=112&fromuid=164951 21世纪大学英语读写教程(第三册)课文翻译 《生物化学》复习资料大全(3套试卷及答案+各章习题集) 《模拟电子技术基础》课后习题答案(共10章)ewthread.php?tid=21&fromuid=164951 《概率论与数理统计及其应用》课后答案(浙江大学盛骤谢式千编著)《理论力学》课后习题答案(赫桐生,高教版) 《全新版大学英语综合教程》(第四册)练习答案及课文译文viewthread.php?tid=78&fromuid=164951 《化工原理答案》课后习题答案(高教出版社,王志魁主编,第三版)《国际贸易》课后习题答案(海闻P.林德特王新奎) 大学英语综合教程1-4册练习答案 read.php?tid=1282&fromuid=164951 《流体力学》习题答案 《传热学》课后习题答案(第四版) 高等数学习题答案及提示

网络技术及应用课后习题及答案

Chap1 一、名词解释 计算机网络三要素:1. 网络服务2. 传输媒介3. 通信协议 分布式网络服务:网络服务分布在网络中的多台或所有计算机中 资源控制策略:网络的目的是共享资源,但对资源的共享并不是没有任何条件的共享,任何一个网络都要对自己的提供的资源进行访问控制,以保证资源的安全及可靠性,并限制用户的资源的访问。 WAN:一个非常大的网。不但可以将多个局域网或城域网连接起来,也可以把世界各地的局域网连接在一起。 LAN:一般指规模相对较小的网络,在地理上局限于较小的范围,通信线路不长 C/S:客户机/服务器(Client/Server) B/S:在C/S模型之后发展起来的浏览器/服务器计算模型 客户机/网络模型:用户登录或访问到的不是某个服务器,而是某个网络!用户与某个服务或一组服务连接,其服务并不属于某个服务器,而是属于整个网络。 二、填空题 1.无论是计算机网络软件的开发,还是硬件的研制,都是围绕着网络共享能力的开发。同时,由此引发的网络安全问题的解决成为网络应用开发研究的核心问题之一。 2.在每个数据分组中加入分组的控制信息主要有两个:一个是指明数据发送方和接收方的地址信息,另一个是对数据进行验证的差错控制信息。 3.在计算机网络的数据传输过程中,数据将通过的不仅是多个通信结点,通过还可能是多种和多个网络。 4.计算机网络提供的网络服务具有两种基本方式,它们分别是:集中式网络服务方式和分布式网络服务。 5.集中式网络服务的劣势之一是由于集中式服务汇集于一点,一旦服务器发生故障,将会引起灾难性地数据丢失或降低可用性;分布式网络服务系统的优势之一是分布式网络服务系统的最大优势在于当一处存储设备的出现故障时,只影响该存储系统的文件服务器上的其他存储设备或其他服务器中的数据将不会受到破坏,并能保证网络正常工作并提供服务。 6.任意一个计算机网络都将提供或具备以下五种基本的网络服务,它们是:文件服务打印服务信息服务应用服务数据库服务。 7.应用服务不同于文件服务,他们之间的差别在于应用服务不仅允许计算机之间可以共享数据,同时还允许计算机之间共享处理能力(共享CPU)。 8.通信子网的主要功能是完成对数据的传输、交换以及控制,具体地实现把信息从一台主机传到另一台主机 9. 在网络协议的层次化结构中,相邻层之间保持着相对的独立性,这是指_低一层的数据处理方法的改变不影响高层功能的执行。 三、简答题 1.简述计算机网络的功能特点。 1. 资源共享 2. 寻址与差错控制 3. 路由选择 4. 会话建立与管理 5. 数据通信与异构多重网络之间的通信 6. 高带宽与多点共享 7. 消除系统之间的差别与加密 8. 负载平衡与拥塞控制 2.简述计算机网络体系架构与计算机网络结构之间的关系。 网络体系结构都是对计算机网络的抽象说明的概念性框架。而网络的实现,则是具体地配置为完成特定的网络服务所需要的设备以及设备之间的连接方式和方法。可见,体系结构是抽象的,而实现则是具体的。然而,任何实现都应该与体系结构一致

药理学——考试题库及答案

糖皮质激素大剂量突击疗法适用于收藏 A. 恶性淋巴瘤 B. 肾病综合征 C. 感染中毒性休克 D. 结缔组织病 回答错误!正确答案:C 氧氯普胺的作用机制与哪个受体有关收藏 A. 5-HT3 B. M1 C. H1 D. D2 回答错误!正确答案: 哪种情况不可以用甲氧氯普胺止吐收藏 A. 胃肠功能失调所致呕吐 B. 晕车所致呕吐 C. 给予顺铂所致呕吐 D. 放疗所致呕吐 回答错误!正确答案:B 甲状腺机能亢进的内科治疗宜选用收藏 A. 甲状腺素 B. 甲硫咪唑 C. 小剂量碘剂 D. 大剂量碘剂 回答错误!正确答案:B

关于碘下列说法不正确的是 收藏 A. 长期大量应用可诱发甲亢 B. 小剂量碘参与甲状腺激素合成 C. 大剂量碘抑制甲状腺激素合成 D. 大剂量碘可治疗单纯性甲状腺肿 回答错误!正确答案:D 属于广谱抗心律失常药的是 收藏 A. 奎尼丁 B. 苯妥英钠 C. 普罗帕酮 D. 利多卡因 回答错误!正确答案:A 关于呋噻米的药理作用特点中,叙述错误的是 收藏 A. 影响尿的浓缩功能 B. 抑制髓袢升支对钠、氯离子的重吸收 C. 肾小球滤过率降低时仍有利尿作用 D. 肾小球滤过率降低时无利尿作用 回答错误!正确答案:D 氯丙嗪引起视力模糊、心动过速和口干、便秘等是因为阻断了收藏 A. 多巴胺受体 B. M受体 C. β受体 D. N受体 回答错误!正确答案:B

与双胍类药物作用无关的是 收藏 A. 可减少肠对葡萄糖的吸收 B. 增加外周组织对葡萄糖的摄取 C. 对正常人血糖几无影响 D. 对胰岛功能缺乏的糖尿病人无降糖作用回答错误!正确答案:D 羧苄西林和下列何药混合注射会降低疗效收藏 A. 庆大霉素 B. 青霉素G C. 磺胺嘧啶 D. 红霉素 回答错误!正确答案:A 主要毒性为视神经炎的抗结核药是 收藏 A. 链霉素 B. 利福平 C. 乙胺丁醇 D. 异烟肼 回答错误!正确答案:C 高血钾症用哪种药物治疗 收藏 A. 氯化钾 B. 葡萄糖、胰岛素 C. 二甲双胍 D. 格列喹酮 回答错误!正确答案:B

(完整版)现代通信系统与网络课后题答案(部分)

第一章 1.你对信息技术如何理解?信息时代的概念是什么? 答:信息技术是研究完成信息采集、加工、处理、传递、再生和控制的技术,是解放、扩展人的信息功能的技术。概念是信息技术为核心推动经济和社会形态发生重大变革。 2.NII GII的含义是什么? 答:NII国家信息基础结构行动计划。GII全球信息基础设施。 3.现代通信的基本特征是什么?它的核心是什么? 答:现代通信的基本特征是数字化,核心是计算机技术。 4.数字通信与模拟通信的主要区别是什么?试举例说明人们日常生活中的信息服务,哪些是模拟通信,哪些是数字通信。 答:模拟信号的电信号在时间上、瞬时值上是连续的,模拟信号技术简单,成本低,缺点是干扰严重,频带不宽、频带利用率不高、信号处理难、不易集成和设备庞大等。数字信号在时间,瞬时值上是离散的,编为1或0的脉冲信号。 5.数字通信的主要特点有哪些? 答:数字通信便于存储、处理;数字信号便于交换和传输;数字信号便于组成多路通信系统;便于组成数字网;数字化技术便于通信设备小型化、微型化;数字通信抗干扰性强,噪声不积累。 6.为什么说数字通信抗干扰性强?噪声不积累? 答:在模拟通信中,由于传输的信号是模拟信号,因此

很难把噪声干扰分开而去掉,随着传输距离的增加,信号的传输质量会越来越恶化。在数字通信中,传输的是脉冲信号,这些信号在传输过程中,也同样会有能量损失,受到噪声干扰,当信噪比还未恶化到一定程度时,可在适当距离或信号终端经过再生的方法,使之恢复原来的脉冲信号,消除干扰和噪声积累,就可以实现长距离高质量的通信。 7.你对网络全球化如何理解?它对人类生活将带来什么样的影响? 答:我认为网络全球化是以内特网为全球范围的公共网,用户数量与日俱增,全球各大网络公司抢占内特网网络资源,各国政府高度重视,投资研发的网络,全球网络化的发展趋势是即能实现各国国情的应用服务,又能实现突破地区、国家界限的世界服务,使世界越来越小。 8.什么是现代通信?它与信息网关系如何? 答:现代通信就是数字通信系统与计算机融合,实现信源到信宿之间完成数字信号处理、传输和交换全过程。 信息网是多种通信系统综合应用的产物,信息网源于通信系统,但高于通信系统,通信系统是各种网不可缺少的物质基础。通信系统可以独立地存在并组成网络,而通信网不可能离开系统而单独存在。 9.信息网的网络拓扑结构有哪几种类型,各自有何特点? 答:有星型网,以一中点向四周辐射,现在的程控交换局与其所在的各电话用户的连线就是这种结构。

《计算机网络》第3版课后题参考答案(徐敬东、张建忠编著)

第1章计算机网络的基本概念 一、填空题 (1)按照覆盖的地理范围,计算机网络可以分为局域网、城域网、和广域网。 (2)ISO/OSI参考模型将网络分为物理层、数据链路层、网络层、传输层、会话层、表示层和应用层。 (3)建立计算机网络的主要目的是:资源共享和在线通信。 二、单项选择题 (1)在TCP/IP体系结构中,与OSI参考模型的网络层对应的是:( B ) A.主机-网络层 B.互联层 C.传输层 D.应用层 (2)在OSI参考模型中,保证端-端的可靠性是在哪个层次上完成的?( C ) A.数据链路层 B.网络层 C.传输层 D.会话层 三、问答题 计算机网络为什么采用层次化的体系结构? 【要点提示】采用层次化体系结构的目的是将计算机网络这个庞大的、复杂的问题划分成若干较小的、简单的问题。通过“分而治之”,解决这些较小的、简单的问题,从而解决计算机网络这个大问题(可以举例加以说明)。

第2章以太网组网技术 一、填空题 (1)以太网使用的介质访问控制方法为CSMA/CD。 (2)计算机与10BASE-T集线器进行连接时,UTP电缆的长度不能超过100米。在将计算机与100BASE-TX集线器进行连接时,UTP 电缆的长度不能超过100米。 (3)非屏蔽双绞线由4对导线组成,10BASE-T用其中的2对进行数据传输,100BASE-TX用其中的2对进行数据传输。 二、单项选择题 (1)MAC地址通常存储在计算机的( B ) A.内存中 B.网卡上 C.硬盘上 D.高速缓冲区 (2)关于以太网中“冲突”的描述中,正确的是( D ) A.冲突时由于电缆过长造成的 B.冲突是由于介质访问控制方法的错误使用造成的 C.冲突是由于网络管理员的失误造成的 D.是一种正常现象 (3)在以太网中,集线器的级联( C ) A.必须使用直通UTP电缆 B.必须使用交叉UTP电缆 C.必须使用同一种速率的集线器 D.可以使用不同速率的集线器 (4) 下列哪种说法是正确的?( A ) A.集线器可以对接收到的信号进行放大 B.集线器具有信息过滤功能 C.集线器具有路径检测功能 D.集线器具有交换功能

大学《药理学》试题及答案

大学《药理学》试题及答案 一、名词解释: 1、药理学:研究药物和机体相互作用规律及作用机制的科学。 2、不良反应:用药后出现与治疗目的无关的作用。 3、受体拮抗剂:药物与受体亲和力高,但无内在活性,能阻断激动剂与受体结合,拮抗激 动剂作用。 4、道光效应(首关效应):指某些口服药物经肠粘膜和肝脏被代谢灭活,再进入体循环的 药量减小的现象。 5、生物利用度:指药物被机体吸收进入体循环的分量和速度。 6、眼调节麻痹:因M受体被阻断,睫状肌松弛,悬韧带拉紧,晶体处扁平,屈光度降低, 视近物,此现象称为调节麻痹。 二、单选题(每题2分,共40分) 1、药理学是(C) A.研究药物代谢动力学 B.研究药物效应动力学 C.研究药物与机体相互作用规律及作用机制的科学 D.研究药物的临床应用的科学 2、注射青霉素过敏,引起过敏性休克是(D) A.副作用 B.毒性反应 C.后遗效应 D.变态反应 3、药物的吸收过程是指(D) A.药物与作用部位结合 B.药物进入胃肠道 C.药物随血液分布到各组织器官 D.药物从给药部位进入血液循环 4、下列易被转运的条件是(A) A.弱酸性药在酸性环境中 B.弱酸性药在碱性环境中 C.弱碱性药在酸性环境中 D.在碱性环境中解离型药 5、药物在体内代谢和被机体排出体外称(D) A.解毒 B.灭活 C.消除 D.排泄 E.代谢 6、M受体激动时,可使(C) A.骨骼肌兴奋 B.血管收缩,瞳孔放大 C.心脏抑制,腺体分泌,胃肠平滑肌收缩 D.血压升高,眼压降低 7、毛果芸香碱主要用于(D) A.肠胃痉挛 B.尿潴留 C.腹气胀 D.青光眼 8、新斯的明最强的作用是(B) A.兴奋膀胱平滑肌 B.兴奋骨骼肌 C.瞳孔缩小 D.腺体分泌增加 9、氯解磷定可与阿托品合同治疗有机磷酸酯类中毒最显著缓解症状是(C) A.中枢神经兴奋 B.视力模糊 C.骨骼肌震颤 D.血压下降

(完整版)计算机通信与网络课后题答案

1.3计算机通信的本质 计算机通信与传统的电话通信、电报通信不同,计算机通信是实现计算机与计算机(包括服务器),或人(通过终端、微机或计算机)与计算机之间的数据信息的生成、传送、交换、存储和处理,其实质是计算机进程之间的通信。 1.8现代电信网的组成 现代电信网是一个复杂的通信系统。从通信模型的角度分,现代电信网的组成可包含三个部分:终端子系统、交换子系统和传输子系统。其主要功能是面向公众提供全程、全网的数据传送、交换和处理服务。 从网络角度来分,传输系统可分为两大类:中继传输系统和用户传输系统。从传输信息特征来分,可分为模拟传输系统和数字传输系统两种。 1.15物联网:指在物理世界的实体中部署具有一定感知能力,计算能力或执行能力的各种信息传感设备,通过网络设施实现信息传输、协同和处理,从而实现广域或大范围的人与物、物与物之间的信息交换需求的互联。 2.4网络协议:计算机网络中的数据交换必须遵守事先约定好的规则,这些规则明确规定了所交换的数据的格式以及有关的同步问题,为进行网络中的数据交换而建立的规则、标准或约定即网络协议,简称为协议。 网络协议的3个基本要素: 语义:需要发出何种控制信息,完成何种动作以及做出何种响应。 语法:数据与控制信息的结构或格式。 定时规则:明确实现通信的顺序、速率、速配及排序。 2.7OSI服务与协议的关系及区别: 关系:首先,协议的实现保证了能够向它上一层提供服务。本层的服务用户只能看见服务而无法看见下面的协议。其次,协议是水平的且协议是控制对对等实体之间通信的规则,但服务是垂直的;另外,并非在一个层内完成的全部功能称为服务。 区别:服务是网络体系结构中各层想他的上层提供的一组原语(操作)。服务描述两层之间的接口,下层是服务的提供者,上层是服务用户;而协议是定义同层对等实体间交换帧,数据包的格式和意义的一组规则。 2.9协议数据单元(PDU):在不同的开放系统的对等实体间交换信息是在相关层的通信规程控制下完成的,这类信息传送单元称为协议数据单元(PDU)。它由两部分组成:上一层的服务数据单元(SDU)、本层的协议控制信息(PCI)。 OSI各层的协议数据单元(PDU)分别是物理层、数据链路层、网络层、传输层、会话层、表示层、应用层。 物理层:主要功能是完成相邻接点原始比特流的传输; 数据链路层:主要功能是加强物理层传输比特的主要功能使之对网络层显现为一条无错线路。 网络层:主要功能是完成网络中主机间的报文传输,其关键问题之一是使用数据链路层的服务将每个报文分组从源端传输到目的端; 传输层:主要功能是从会话层接收数据且在必要时把它分成较小的单元。

最新大学物理实验教材课后思考题答案

大学物理实验教材课后思考题答案 一、转动惯量: 1.由于采用了气垫装置,这使得气垫摆摆轮在摆动过程中受到的空气粘滞阻尼力矩降低至最小程度,可以忽略不计。但如果考虑这种阻尼的存在,试问它对气垫摆的摆动(如频率等)有无影响?在摆轮摆动中,阻尼力矩是否保持不变? 答:如果考虑空气粘滞阻尼力矩的存在,气垫摆摆动时频率减小,振幅会变小。(或者说对频率有影响, 对振幅有影响) 在摆轮摆动中,阻尼力矩会越变越小。 2.为什么圆环的内、外径只需单次测量?实验中对转动惯量的测量精度影响最大的是哪些因素? 答:圆环的内、外径相对圆柱的直径大很多,使用相同的测量工具测量时,相对误差较小,故只需单次测 量即可。(对测量结果影响大小) 实验中对转动惯量测量影响最大的因素是周期的测量。(或者阻尼力矩的影响、摆轮是否正常、平稳的摆动、物体摆放位置是否合适、摆轮摆动的角度是否合适等) 3.试总结用气垫摆测量物体转动惯量的方法有什么基本特点? 答:原理清晰、结论简单、设计巧妙、测量方便、最大限度的减小了阻尼力矩。 三、混沌思考题 1. 精品文档

有程序(各种语言皆可)、K值的取值范围、图 +5分 有程序没有K值范围和图 +2分 只有K值范围 +1分 有图和K值范围 +2分 2.(1).混沌具有内在的随机性:从确定性非线性系统的演化过程看,它们在混沌区的行为都表现出随机不确定性。然而这种不确定性不是来源于外部环境的随机因素对系统运动的影响,而是系统自发 精品文档

精品文档 产生的 (2).混沌具有分形的性质(3).混沌具有标度不变性(4).混沌现象还具有对初始条件的敏感依赖性:对具有内在随机性的混沌系统而言,从两个非常接近的初值出发的两个轨线在 经过长时间演化之后,可能变得相距“足够”远,表现出对初值的极端敏感,即所谓“失之毫厘,谬之千里”。 答对2条以上+1分,否则不给分,只举例的不给分。 四、半导体PN 结 (1)用集成运算放大器组成电流一电压变换器测量11610~10--A 电流,有哪些优点? 答:具有输入阻抗低、电流灵敏度高、温漂小、线性好、设计制作简单、结构牢靠等优点。 (2)本实验在测量PN 结温度时,应该注意哪些问题? 答:在记录数据开始和结束时,同时都要记录下干井中温度θ,取温度平均值θ。 (3)在用基本函数进行曲线拟合求经验公式时,如何检验哪一种函数式拟合得最好,或者拟合的经验公式最符合实验规律? 答:运用最小二乘法,将实验数据分别代入线性回归、指数回归、乘幂回归这三种常用的基本函数,然后求出衡量各回归方程好坏的拟合度R 2。拟合度最接近于1的函数,拟合得最好。 五、地磁场 (1)磁阻传感器和霍耳传感器在工作原理有什么区别? 答:前者是磁场变化引起材料阻值变化,最终使得电桥外接电压转变为对应的输出电压;后者是磁场变化引起流经材料内部的载流子发生偏转而产生电压。 (2)为何坡莫合金磁阻传感器遇到较强磁场时,其灵敏度会降低?用什么方法来恢复其原来的灵敏度? 答:传感器遇到强磁场感应时,对应的磁阻材料将产生磁畴饱和现象,外加磁场很难改变磁阻材料的

计算机网络-清华版_吴功宜(第三版)课后习题解答选择题培训讲学

第一章选择题 1、计算机网络共享的资源是计算机的软件硬件与数据 2、早期ARPANET 中使用的IMO从功能上看,相当于目前广泛使用的路由器 3、关于计算机网络形成的标志性成果的描述中错误的是哦死参考模型为网络协议的研究提供了理 论依据 4、ARPANET最早推出的网络应用是TELNET 5、对ARPANET研究工作的描述错误的是提出了ipv6地址的划分方法 6、以下关于物联网技术的描述中错误的是物联网的应用可以缓解ip地址匮乏问题 7、以下关于无线网络技术特点的描述中错误的是WMAN不需要有基站 8、以下关于计算机网络定义药店的描述中错误的是联网计算机之间的通信必须遵循TCP/IP 9、以下属于定义中错误的是“intranet”是依据osi参考模型与协议组建的计算机网络 10、以下关于网络拓扑的描述中错误的是网络拓扑研究的是资源子王中节点的结构关系问题 11、以下关于网络分类的描述中错误的是连接用户计算机身边10m之内计算机等数字终端设备的 网络称为WSN 12、以下关于广域网特征的描述中错误的是广域网的核心技术是线路交换技术 13、以下关于网络城域网的描述中错误的是第二层交换机是宽带城域网的核心设备 14、以下关于局域网特征的描述中错误的是提供高数据传输速率(1.544~51.84Mbps)、低误码率 的高质量数据传输环境 15、以下关于蓝牙技术的描述中错误的是与IEEE 802.15.4标准兼容 16、以下关于ZigBee技术特点的描述中错误的是与IEEE802.15.4的MAC层协议不兼容 17、以下关于ISP概念的描述中错误的是第一层的国家服务提供商NSP是由ISOC批准的 18、以下关于internet核心交换与边缘部分结构特点的描述中错误的是边缘部分的段系统是由路 由器组成 19、以下关于环状拓扑结构特点的描述中错误的是环中数据可以沿两个方向逐站传送 20、以下关于数据报传输方式的特点的描述中错误的是数据报方式适用于长报文、会话式通信 第二章 选择题 1.以下关于网络协议与协议要素的描述正确的是A A.协议表示网络功能是什么 B.语义表示是要做什么 C.语法表示要怎么做 D.时序表示做的顺序 2.以下关于网络体系结构概念的描述中错误的是B A.网络体系结构是网络层次结构模型与各层协议的集合 B.所有的计算机网络都必须遵循0SI体系结构 C.网络体系结构是抽象的,而实现网络协议的技术是具体的 D.网络体系结构对计算机网络应该实现的功能进行精确定义 3.以下关于网络体系结构的研究方法优点的描述中错误的是C A.各层之间相互独立 B.易于实现和标准化 C.允许隔层通信是0SI参考模型灵活性的标志 D.实现技术的变化都不会对整个系统工作产生影响 4.以下关于0SI参考樽型的基本概念的描述中错误的是A A.术语"0SI参考模型"中的开放是指可以用于任何一种计算机的操作系统 B.0SI参考模型定义了开放系统的层次结构,层次之间的相互关系 C.0SI的服务定义详细地说明了各层所提供的服务,不涉及接口的具体实现方法 D.0SI参考模型不是一个标准.而是一种在制定标准时所使用的概念性的框架

药理学试题库和答案

药理学题库及答案 一.填空题 1.药理学的研究内容是()和()。 2.口服去甲肾上腺素主要用于治疗()。 3.首关消除较重的药物不宜()。 4.药物排泄的主要途径是()。 受体激动时()兴奋性增强。 5.N 2 6.地西泮是()类药。 7.人工冬眠合剂主要包括()、()和()。8.小剂量的阿司匹林主要用于防治()。 9.山梗菜碱属于()药。(填药物类别) 10.口服的强心甙类药最常用是()。 11.阵发性室上性心动过速首选()治疗。 12.螺内酯主要用于伴有()增高的水肿。 受体阻断药主要用于()过敏反应性疾病。 13.H 1 14.可待因对咳漱伴有()的效果好.但不宜长期应用.因为它有()性。 15.胃壁细胞H+泵抑制药主要有()。 16.硫酸亚铁主要用于治疗()。 17.氨甲苯酸主要用于()活性亢进引起的出血。 18.硫脲类药物用药2-3周才出现作用.是因为它对已经合成的()无效。硫脲类药物用药期间应定期检查()。 19.小剂量的碘主要用于预防()。 20.伤寒患者首选()。 21.青霉素引起的过敏性休克首选()抢救。 22.氯霉素的严重的不良反应是()。 23.甲硝唑具有()、()和抗阿米巴原虫的作用。 24.主要兴奋大脑皮层的中枢兴奋药物药物有__________,主要通过刺激化学感 受器间接兴奋呼吸中枢的药物有____________。

25.久用糖皮质激素可产生停药反应.包括(1)._______________(2).__________ 26.抗心绞痛药物主要有三类.分别是;和药。27.药物的体内过程包括、、和排泄四个过程。 28.氢氯噻嗪具有、和作用。30.联合用药的主要目的是、、。31.首关消除只有在()给药时才能发生。 32.药物不良反应包括()、()、()、()。33.阿托品是M受体阻断药.可以使心脏().胃肠道平滑肌(). 腺体分泌()。 34.氯丙嗪阻断α受体.可以引起体位性()。 35.腹部手术止痛时.不宜使用吗啡的原因是因为吗啡能引起()。36.对乙酰氨基酚也叫()。 37.解热镇痛药用于解热时用药时间不宜超过()。 38.洛贝林属于()药。 39.硝酸甘油舌下含服.主要用于缓解()。 40.心得安不宜用于由冠状血管痉挛引起的()型心绞痛。 41.小剂量维持给药缓解慢性充血性心衰.常用药物是()。 42.螺内酯主要用于伴有()增多的水肿。 43.扑尔敏主要用于()过敏反应性疾病。 44.对β 受体选择性较强的平喘药有()、()等。 2 45.法莫替丁能抑制胃酸分泌.用于治疗()。 46.硫酸亚铁用于治疗()。 47.氨甲苯酸可用于()活性亢进引起的出血。

通信网络基础 (李建东 盛敏 )课后习题答案

1.1答:通信网络由子网和终端构成(物理传输链路和链路的汇聚点),常用的通信网络有A TM 网络,X.25分组数据网络,PSTN ,ISDN ,移动通信网等。 1.2答:通信链路包括接入链路和网络链路。 接入链路有:(1)Modem 链路,利用PSTN 电话线路,在用户和网络侧分别添加Modem 设备来实现数据传输,速率为300b/s 和56kb/s ;(2)xDSL 链路,通过数字技术,对PSTN 端局到用户终端之间的用户线路进行改造而成的数字用户线DSL ,x 表示不同的传输方案;(3)ISDN ,利用PSTN 实现数据传输,提供两个基本信道:B 信道(64kb/s ),D 信道(16kb/s 或64kb/s );(4)数字蜂窝移动通信链路,十几kb/s ~2Mb/s ;(5)以太网,双绞线峰值速率10Mb/s,100Mb/s 。 网络链路有:(1)X.25提供48kb/s ,56kb/s 或64kb/s 的传输速率,采用分组交换,以虚电路形式向用户提供传输链路;(2) 帧中继,吞吐量大,速率为64kb/s ,2.048Mb/s ;(3)SDH (同步数字系列),具有标准化的结构等级STM-N ;(4)光波分复用WDM ,在一根光纤中能同时传输多个波长的光信号。 1.3答:分组交换网中,将消息分成许多较短的,格式化的分组进行传输和交换,每一个分组由若干比特组成一个比特串,每个分组 都包括一个附加的分组头,分组头指明该分组的目的节点及其它网络控制信息。每个网络节点采用存储转发的方式来实现分组的交换。 1.4答:虚电路是分组传输中两种基本的选择路由的方式之一。在一个会话过程开始时,确定一条源节点到目的节点的逻辑通路,在 实际分组传输时才占用物理链路,无分组传输时不占用物理链路,此时物理链路可用于其它用户分组的传输。会话过程中的所有分组都沿此逻辑通道进行。而传统电话交换网PSTN 中物理链路始终存在,无论有无数据传输。 1.5答:差别:ATM 信元采用全网统一的固定长度的信元进行传输和交换,长度和格式固定,可用硬件电路处理,缩短了处理时间。为 支持不同类型的业务,ATM 网络提供四种类别的服务:A,B,C,D 类,采用五种适配方法:AAL1~AAL5,形成协议数据单元CS-PDU ,再将CS-PDU 分成信元,再传输。 1.7答:OSI 模型七个层次为:应用层,表示层,会话层,运输层,网络层,数据链路层,物理层。TCP/IP 五个相对独立的层次为: 应用层,运输层,互联网层,网络接入层,物理层。 它们的对应关系如下: OSI 模型 TCP/IP 参考模型 1.10解:()()Y t t X +=π2cos 2 ()()Y Y X cos 22cos 21=+=π

大学教材课后习题答案免费下载链接下部

大学教材课后习题答案免费下载链接 (上中下)190-290 本资料由https://www.wendangku.net/doc/ff70125.html,上网购返利网分享汽车理论习题答案(考研_作业).pdf→→ https://www.wendangku.net/doc/ff70125.html,/s/1zobam 汽车理论第五版_课后习题答案(正确).pdf→→ https://www.wendangku.net/doc/ff70125.html,/s/1o67DaHk 波动习题答案.pdf→→https://www.wendangku.net/doc/ff70125.html,/s/1pJDGFyj 泵与风机课后习题答案.pdf→→https://www.wendangku.net/doc/ff70125.html,/s/1gdBph3H 流体力学习题解答李晓燕吴邦喜.pdf→→ https://www.wendangku.net/doc/ff70125.html,/s/1qWM2gAo 液压与气压传动习题答案.pdf→→ https://www.wendangku.net/doc/ff70125.html,/s/1bnksUmV 物理化学第五版习题解答(上下册).pdf→→ https://www.wendangku.net/doc/ff70125.html,/s/1sjvvFPj 物理学教程第二版马文蔚下册课后答案完整版_cropped.pdf→→https://www.wendangku.net/doc/ff70125.html,/s/1sj98Mct 物理学第五版上册习题答案.pdf→→ https://www.wendangku.net/doc/ff70125.html,/s/1jG1F9NS 王勖成《有限单元法》1-5章课后习题答案.pdf→→ https://www.wendangku.net/doc/ff70125.html,/s/1nt8vc3B 理论力学教程_第三版_周衍柏_课后习题答案_总汇(1).pdf→→

理论力学教程_第三版_周衍柏_课后习题答案_总汇.pdf→→https://www.wendangku.net/doc/ff70125.html,/s/1eQABmxW 电力系统分析课后习题答案.pdf→→ https://www.wendangku.net/doc/ff70125.html,/s/1bngpktD 电动力学习题答案chapter5.pdf→→ https://www.wendangku.net/doc/ff70125.html,/s/1pJ7AZ5x 电子商务法律与法规综合复习题与答案.pdf→→ https://www.wendangku.net/doc/ff70125.html,/s/1c0nEFUo 电子测量技术基础课后习题答案上1,2,5,6,7,8.pdf→→https://www.wendangku.net/doc/ff70125.html,/s/1hq3f7Is 电子线路习题答案梁明理版.pdf→→ https://www.wendangku.net/doc/ff70125.html,/s/1bn5rEIr 电工学简明教程(第二版)学习辅导与习题解答.pdf→→https://www.wendangku.net/doc/ff70125.html,/s/1mgHQ6xi 电机与拖动基础第三版李发海答案(全).pdf→→https://www.wendangku.net/doc/ff70125.html,/s/1dD25KyP 电气测试技术第三版_课后习题答案%28林德杰%29.pdf→→https://www.wendangku.net/doc/ff70125.html,/s/1jGwVRE2 电磁场与电磁波习题答案 (6).pdf→→ https://www.wendangku.net/doc/ff70125.html,/s/1bnrK3pX 电磁场与电磁波习题答案 (7).pdf→→

计算机网络课后题答案

第三章 1.网卡的主要功能有哪些?它实现了网络的哪几层协议? 网卡工作在OSI模型的数据链路层,是最基本的网络设备,是单个计算机与网络连接的桥梁。它主要实现如下功能: (1) 数据的封装与解封,信号的发送与接收。 (2) 介质访问控制协议的实现。采用不同拓扑结构,对于不同传输介质的网络,介质的 访问方式也会有所不同,需要有相应的介质访问控制协议来规范介质的访问方式,从而使网络用户方便、有效地使用传输介质传递信息。 (3) 串/并行转换。因为网卡通过总线以并行传输方式与计算机联系,而网卡与网络的通 信线路采用串行传输方式联系,所以网卡应具有串/并行转换功能。 (4) 发送时,将计算机产生的数字数据转变为适于通信线路传输的数字信号形式,即编 码;接收时,将到达网络中的数字信号还原为原始形式,即译码。 2.网卡有几种分类方式? 1.按连接的传输介质分类 2.按照总线类型分类 3.使用粗缆、细缆及双绞线的网卡接口名称分别是什么? 粗缆网卡使用AUI连接头,用来连接收发器电缆,现在已经看不到这种网卡的使用了。 细缆网卡使用BNC连接头,用来与BNC T型连接头相连,现在也很少使用,在一些布网较早的单位还可以见到。连接同轴电缆的网卡速率一般为10 Mb/s。双绞线网卡是现在最常用的,使用RJ-45插槽,用来连接网线的RJ-45插头。 4.简述安装网卡的主要步骤。 对于台式计算机,若使用USB网卡,则只要将网卡插入计算机的USB接口中就可以了; 若使用ISA或者PCI网卡,则需以下安装步骤: (1) 断开电源,打开机箱。 (2) 在主板上找到相应的网卡插槽,图3.8所示为ISA插槽和PCI插槽。选择 要插入网卡的插槽,将与该插槽对应的机箱金属挡板取下,留下空缺位置 (3)将网卡的金属挡板朝向机箱背板,网卡下方的插条对准插槽,双手均匀用 力将网卡插入插槽内,这时网卡金属挡板正好填补了上一步操作留下的空缺位置 (4) 根据机箱结构,需要时用螺丝固定金属挡板,合上机箱即可。 对于笔记本电脑,网卡的安装较为简单。首先找到笔记本的PCMCIA 插槽,如图3.10所示,然后将PCMCIA网卡有金属触点的一头插入PCMCIA 插槽,这样网卡就安装好了 5.集线器是哪一层的设备,它的主要功能是什么? 集线器属于物理层设备,它的作用可以简单的理解为将一些机器连接起来组成一个局域网。 6.在集线器或交换机的连接中,级联与堆叠连接方式有什么异同? 1.级联是通过集线器的某个端口与其他集线器相连,堆叠是通过集线器背板上的专用堆叠 端口连接起来的,该端口只有堆叠式集线器才具备。 2.距离不同堆叠端口之间的连接线也是专用的。堆叠连接线长度很短,一般不超过1 m, 因此与级联相比,堆叠方式受距离限制很大。 3.但堆叠线缆能够在集线器之间建立一条较宽的宽带链路,再加上堆叠单元具有可管理 性,这使得堆叠方式在性能方面远比级联方式好。 7.交换机是哪一层的设备,它的主要功能是什么? 交换机是二层网络设备(即OSI参考模型中的数据链路层)。

通信网理论基础习题答案 完整版

2.2 求M/M/m (n )中,等待时间w 的概率密度函数。 解: M/M/m (n )的概率分布为: 1 1010011!)(!)(--=--?? ????--+=∑m r m n m k m m p k m p ρρρρ ??? ? ???>≤≤-≤≤=n k n k m p k m m k p k m p k m k k 0!10!)(00ρρ 假定n>m ,n ≥0,现在来计算概率P{w>x},既等待时间大于x 的概率。 ∑=>?=>n j j j x w P p x w P 0 }{}{ 其中,P j {w>x}的概率为: n j m x w P n j m i x m e x w P m j x w P j m j i i x m j j ≤≤=>-≤≤? = >-≤≤=>∑-=-1 }{1! )(}{1 00 }{0 μμ 可得: x m m n n i m m n i i x m m n m j n m j i i x m j m n n m j m j i i x m j e m m P x w P 则 若n P i x m e P m m i x m e P m m P i x m e P x w P )(010 010010 ! )(1}{1!)(!!)(!! )(}{λμμμμρρρρρμρμρμ--+--=--=-=--=-=-?-=>∞→+--?=??????+??=+??=>∑∑∑∑∑ 特别的,新到顾客需等待的概率为: ! )(1}0{0m m P W P m ρρ? -=>

] )! 1() ()!1()(!)()([)1(!)(而 1 2 10--------=----=---∑m n m m m n x m i x m e m P m x f m n n m n i m n m i m x m m w μλμρλμρλλμρρμ n m k k x m m m w P w P P w P 注: e m m P m x f 在n =∞===--=∞→∑-=--}{}0{)() 1(!)(10 )(0 λμλμρρ 2.4求M/D/1排队问题中等待时间W 的一、二、三阶矩m 1、m 2、m 3,D 表示服务时间为定值b ,到达率为λ。 解: ) () 1()(S B s s s G λλρ+--= 其中 sb st e dt e b t s B -∞ -=-= ? )()(δ 从而 sb e s s s G -+--=λλρ)1()( 又 ∑∞ ==0 )(i i i s g s G )1(!)(00ρλλ-=??? ? ??-?+-??? ??∴∑∑∞ =∞=s j sb s s g j j i i i b g λρ--=110 221)1(2)1(b b g λρλ---= 3 4232) 1(12)2)(1(b b b g λλλρ-+-= 3 4 332 3 222 114 43)1(4)21(6)0()1(6)2(2)0()1(2)0() () 1(24)1)(21(ρλρρλρρλρλλλρλ-+= ?='''-=-+= ?=''=-= -='-==--+-=b g G m b g G m b g G m b b b b g 2.5 求M/B/1,B/M/1和B/B/1排队问题的平均等待时间W ,其中B 是二阶指数分布: 100 ,)1()(212121<<>-+=--αλλλααλλλt t e e t f

大学物理学(第三版)课后习题参考答案

习题1 1.1选择题 (1) 一运动质点在某瞬时位于矢径),(y x r 的端点处,其速度大小为 (A)dt dr (B)dt r d (C)dt r d | | (D) 22)()(dt dy dt dx [答案:D] (2) 一质点作直线运动,某时刻的瞬时速度s m v /2 ,瞬时加速度2 /2s m a ,则一秒钟后质点的速度 (A)等于零 (B)等于-2m/s (C)等于2m/s (D)不能确定。 [答案:D] (3) 一质点沿半径为R 的圆周作匀速率运动,每t 秒转一圈,在2t 时间间隔中,其平均速度大小和平均速率大小分别为 (A) t R t R 2, 2 (B) t R 2,0 (C) 0,0 (D) 0,2t R [答案:B] 1.2填空题 (1) 一质点,以1 s m 的匀速率作半径为5m 的圆周运动,则该质点在5s 内,位移的大小 是 ;经过的路程是 。 [答案: 10m ; 5πm] (2) 一质点沿x 方向运动,其加速度随时间的变化关系为a=3+2t (SI),如果初始时刻质点的速度v 0为5m·s -1,则当t 为3s 时,质点的速度v= 。 [答案: 23m·s -1 ] (3) 轮船在水上以相对于水的速度1V 航行,水流速度为2V ,一人相对于甲板以速度3V 行走。如人相对于岸静止,则1V 、2V 和3V 的关系是 。 [答案: 0321 V V V ]

1.3 一个物体能否被看作质点,你认为主要由以下三个因素中哪个因素决定: (1) 物体的大小和形状; (2) 物体的内部结构; (3) 所研究问题的性质。 解:只有当物体的尺寸远小于其运动范围时才可忽略其大小的影响,因此主要由所研究问题的性质决定。 1.4 下面几个质点运动学方程,哪个是匀变速直线运动? (1)x=4t-3;(2)x=-4t 3+3t 2+6;(3)x=-2t 2+8t+4;(4)x=2/t 2-4/t 。 给出这个匀变速直线运动在t=3s 时的速度和加速度,并说明该时刻运动是加速的还是减速的。(x 单位为m ,t 单位为s ) 解:匀变速直线运动即加速度为不等于零的常数时的运动。加速度又是位移对时间的两阶导数。于是可得(3)为匀变速直线运动。 其速度和加速度表达式分别为 2 2484 dx v t dt d x a dt t=3s 时的速度和加速度分别为v =20m/s ,a =4m/s 2。因加速度为正所以是加速的。 1.5 在以下几种运动中,质点的切向加速度、法向加速度以及加速度哪些为零哪些不为零? (1) 匀速直线运动;(2) 匀速曲线运动;(3) 变速直线运动;(4) 变速曲线运动。 解:(1) 质点作匀速直线运动时,其切向加速度、法向加速度及加速度均为零; (2) 质点作匀速曲线运动时,其切向加速度为零,法向加速度和加速度均不为零; (3) 质点作变速直线运动时,其法向加速度为零,切向加速度和加速度均不为零; (4) 质点作变速曲线运动时,其切向加速度、法向加速度及加速度均不为零。 1.6 |r |与r 有无不同?t d d r 和d d r t 有无不同? t d d v 和t d d v 有无不同?其不同在哪里?试举例说明. 解:(1)r 是位移的模, r 是位矢的模的增量,即r 12r r ,12r r r ; (2) t d d r 是速度的模,即t d d r v t s d d . t r d d 只是速度在径向上的分量. ∵有r r ?r (式中r ?叫做单位矢),则 t ?r ?t r t d d d d d d r r r 式中 t r d d 就是速度在径向上的分量,

网络配置课后题答案

第一章 1当诊断网络的连接问题时,在PC的DOS命令提示符下使用ping命令,但是输出显示“request times out,”这个问题属于OSI参考模型的哪一层?(C) A.物理层 B. 数据链路层 C. 网络层 D. 传输层 E. 会话层 F. 表示层 G应用层 2当从interest 上的FIP站点上下载一个文件的时候,在 FTP操作的过程中,所关联的OSI 参考模型的最高层是哪层?(E) A.物理层 B. 数据链路层 C. 网络层 D. 传输层 E. 会话层 F. 表示层 G应用层 3在主机在正确地配置了一个静态的IP地址,但是默认网关没有被正确设置的情况下。这个配置错误最先会发生在OSI参考模型的哪一层? (C) A.物理层 B. 数据链路层 C. 网络层 D. 传输层 E. 会话层 F. 表示层 G应用层 4. OSI参考模型的哪一层涉及保证端到端的可靠传输?(D) A.物理层 B. 数据链路层 C. 网络层 D. 传输层 E. 会话层 F. 表示层 G应用层 5. OSI参考模型的哪一层完成差错报告,网络拓扑结构和流量控制的功能?(B) A.物理层 B. 数据链路层 C. 网络层 D. 传输层 E. 会话层 F. 表示层 G应用层 7. 10Base-T使用哪种类型的电缆介质?(D) A. 以太网粗缆 B. 以太网细缆 C. 同轴电缆 D.双绞线 8. 下面关于CSMA/CD 网络的描述,哪一个是正确的?(A) A. 任何一个节点的通信数据都要通过整个网络,并且每一个节点都要接收并检验该数据 B. 如果源节点知道目的地的IP地址和MAC地址,它所发送的信号是直接送往目的地的。 C.一个节点的数据发往最近的路由器,路由器将数据直接发送到目的地 D. 信号都是以广播的方式发送的 9. 网络中使用光缆的有点是什么?(D) A 便宜 B. 容易安装 C.是一个工业标准,很方便购买 D. 传输速率比同轴电缆或者双绞线都高10.当一台计算机发送一封E-mail给另一台计算机的,数据打包所经历的5个步骤是;(A) A. 数据,数据段,数据包,数据帧,比特 B.比特,数据段,数据包,数据帧,数据 C. 数据包,数据段,数据,比特,数据帧 D. 比特,数据帧,数据包,数据段,数据 第二章 1. 下面哪种网络协议在传输过程中既应用了UDP的端口,有应用了TCP端口?(E) A. FTP B. TFTP C. SMTP D.Telnet E. DNS 2. 下面哪些应用服务使用了TCP传输协议?(BDE) A. DHCP B. SMTP C. SNMP D.FTP E. HTTP F.TFTP 3.下面哪些IP地址是在子网192.168.15.19/28中有效的主机地址?(AC) A. 192.168.15.17 B. 192.168.15.14 C. 192.168.15.29 D. 192.168.15.16 E.192.1 68.15.31 4. 如果被分配了一个C类网络地址,但是需要划分10个子网。同时要求每一个子网内主机数量尽可能多。应该选择下面那一项子网掩码来划分这个C类网络? (C) A. 255.255.255.192 B. 255.255.255.224 C. 255.255.255.240 D. 255.255.255.248 5.当使用子网掩码/28来划分一个C类地址,E (AD) A.30个子网,6台主机 B.6个子网,30太主机 C. 8个子网,32台主机 D. 32个子网,18太主机 E. 16个子网,14台主机 6. 一个B类网络地址,它的掩码是255.255.255.0。下面那些选项是对这个网络地址的正确的描述?(D)

- 大学物理学(第三版)课后习题参考答案

- 大学英语课本答案大全

- 大学英语1教材课后答案

- 大学课后习题答案大全

- 理论力学习题答案(中国科技大学出版社教材课后习题)

- 各大学教材课后习题答案网址

- 数据库原理与应用课后答案 清华大学出版社教材

- 大学物理(上册)课后习题及答案

- 大学教材课后题答案网站

- 全新版大学英语(第二版)综合教程2学生用书课后习题答案

- 大学教材课后习题答案免费下载链接下部

- 各大学教材课后习题答案网址[1]1

- 大学英语1教材课后答案

- 大学语文教材课后练习题答案

- 大学教材课后习题答案大全

- 大学课本答案大全

- 大学教材课后习题答案网址

- 大学物理实验教材课后思考题答案

- 大学计算机应用基础课本习题答案

- 大学教材课后习题答案网址